Rapid Growth In Life Science Sector Constrains Capital Projects Supply Chain

By Hector M. Samper, principal and strategic advisor, Global Strategic Sourcing Solutions (GSSS)

According to the latest PharmSource Trend Report, Bio/Pharma CapEx Trends 2016, biopharma companies have invested over $150 billion in new plants and equipment in the past five years. As this sector continues on an upward trend, it is placing significant pressure on the supply chain. Mother Nature in California, Texas, Puerto Rico, Mexico, and Southeast Asia and Amazon’s much-anticipated HQ2 serve as further reminders to plan for mitigating cost and schedule project impact.

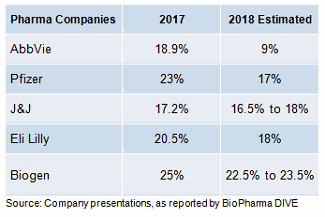

As U.S. pharma companies benefit from corporate tax reform enacted in January 2018, they will have more cash at their disposal. So far, AbbVie, Merck, and Pfizer have announced plans to invest a combined $15.5 billion in domestic projects over the next five years.

Table 1: Effective Tax Rate Impact On Pharma Companies

Companies now view capital programs as significant drivers that contribute to their core value of delivering drug to the patient, and this requires greater due diligence to ensure a successful, outcome-oriented supply chain.

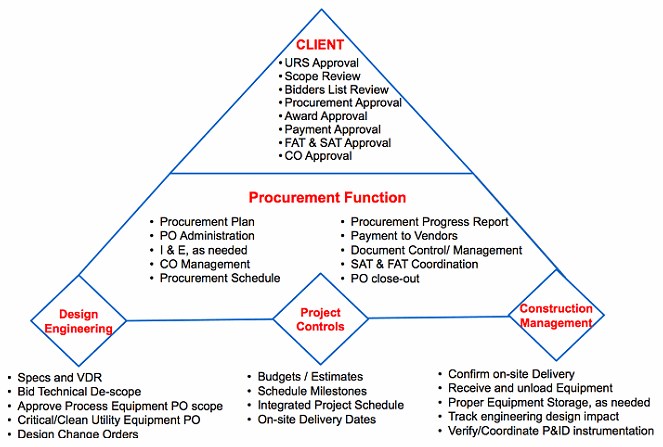

Developing a project execution plan requires sound strategic sourcing that complements the core competencies of the vendors in the supply chain; getting the right procurement plan in place is vital to avoid complications and deliver predictable results.

Figure 1: Project procurement interdependencies

It is often critical to reveal the interdependencies in the supply chain to understand why things happen — promoting an integrated delivery model enables one to see the big picture and all the connections through structured collaboration.

Shifting To A Partnership Mindset

Integrating the supply chain requires a cultural shift, and this can be a big change for those who are new to a partnership-based model. The American Institute of Architects defines integrated project delivery (IPD) as a "collaborative alliance of people, systems, business structures and practices into a process that harnesses the talents and insights of all participants to optimize project results, increase value to the owner, reduce waste, and maximize efficiency through all phases of design, fabrication, and construction.” While this may sound like a “perfect world” in a project management environment, in meaningful and practical ways this approach will improve confidence, communication, and speed to market. One should not only enter into project-based relationships, but also build long-term relationships to unify the objectives and processes.

While most companies recognize the value of an integrated team approach or strive to reach this level of maturity, shifting the paradigm from transactional relationships where suppliers are responsive to purchase orders to a forward-focused relationship will be essential to securing assurance of supply. The automobile industry favors global supply partners, and the benefits have been widely documented.

New technologies are also disrupting the supply chain and contributing to project synergy by revolutionizing construction job sites through the Internet of Things (IoT). Wearables to track field workers, equipment sensors to maintain equipment reliability, virtual and augmented reality technology for safety training, and drones to view job conditions are among the applications that will continue to evolve to promote project synergy and trusted partnership.

It should be understood that teamwork through close cooperation is neither quick nor simple. It requires top management commitment, dedicated resources, and time to build a long-term perspective and plan that can be adapted by the team over time.

As the saying goes, “It takes two to tango.” Suppliers and clients need to be proactive to connect with each other in meaningful and practical ways for mutual value.

Focus on CAPEX Spend Categories Straining the Supply Chain

Increased demand for biopharma process equipment, coupled with pressures on construction labor, threatens the CAPEX supply chain. It will require proactive engagement and increased combined effort to mitigate the risks to cost, schedule, and performance. A balance must be reached between the creation of long-term strategic relationships and cost reduction targets to optimize mutual benefits and yield long-term, sustainable results. To establish a SMART supply chain, consider the following:

- Strategic: Transform supply management operating models to focus on demand-driven planning strategies, value-creating activities, and sustainable procurement practices.

- Managed: Drive a new, integrated relationship management process with suppliers that relies on value creation throughout the total cost of ownership, while leveraging technology to rapidly respond to market changes.

- Aligned: Alignment of mutual business goals enables fulfillment of contractual obligations, triggers innovation, and prompts richer communication.

- Results-oriented: Understand the business needs, and establish key indicators to measure relevant performance.

- Transparent: Embed transparency throughout the governance model, foster internal/external communication, and share lessons from completed projects.

These factors should frame the discussions to establish strategic parameters for the project execution plan while developing the procurement strategy.

The next section will focus on spend categories that heighten the risk on the CAPEX project supply chain and provide a fresh perspective to mitigate these risks.

Biopharma Process Equipment

Supplier relationships are essential to securing assurance of supply; early project team collaboration, vendor/contractor involvement, and an integrated project delivery model can provide real-time information to define a successful and predictable project execution plan. The fast pace of new technology may create laggers in the industry; therefore, it is key to establish early cooperation with OEMs to develop innovative solutions.

Process equipment vendors are essential to develop innovative solutions, and companies that establish early partnerships will remain relevant with evolving technology and benefit from breakthrough design solutions. Increased demand for customized equipment contributes to longer lead time. Therefore, standardization should be aggressively pursued, as industry leaders (e.g., GE, Sartorius, Pall, Millipore) that offer standard solutions are less flexible at customizing and will add significant cost for custom units. Furthermore, skidded design approach is becoming more prevalent and skid manufacturers are running at near-full capacity; early coordination can secure production space while leveraging their design capabilities and resources. CMOs are also contributing to the demand for process equipment, as they continue to consolidate and ramp up their capabilities to meet changing requirements of companies that are increasingly outsourcing.

A noble approach to equipment design and selection should be based on the user requirements specification (URS). However, the tendency to advance the project design schedule from conceptual to design and beyond, in some instances without an approved URS, creates gaps and design changes that inspire vendors to submit change orders.

Company consolidations, process manufacturing changes, and large pharmaceutical companies shifting their presence to biopharma are resulting in considerable surplus equipment. Equipment investment-recovery strategies that include a well-planned and executed redeployment process and the right partners can add flexibility and extend asset utilization across geographically dispersed operations. Experienced asset management companies should be consulted to oversee and facilitate the internal transfer or sale of equipment.

Europe can offer an alternate supplier base, as can China and India to some extent. New entrants and less popular vendors should be proactively qualified. However, according to analysts at Deutsche Bank, the Euro to U.S. dollar rate will rise to a 1.30 by the end of 2018, therefore making European vendors less competitive.

It is critical to shift the conversation from RFP to collaboration and partnership while focusing on total cost of ownership and value creation through supplier flexibility and joint effort.

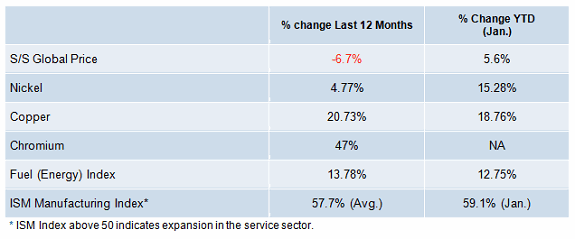

Table 2: Market Indicators That Can Influence The Cost Of Equipment

While the unit cost of producing commodities has been falling compared to the market due to technology advancements, the price of commodities is determined primarily by the supply and demand for the commodity in the market. Therefore, in a busy construction sector, expect prices to be volatile.

U.S. Construction Supply Market

All signs point to a huge construction increase, with particular strength in private construction projects. As the construction labor market tightens, the demand for skilled labor is expected to cause pervasive delays and increase labor costs by double-digit percentages. The Turner Building Cost Index, which measures the non-residential building construction market in the U.S., has increased 1.34 percent from the third quarter of 2016 and 5.17 percent from the fourth quarter of 2016. “The shortage of skilled labor continues to be a key factor in cost increases across the construction industry,” said Attilio Rivetti, the Turner vice president responsible for the Cost Index. He continued, “As we move into 2017, we expect this focus on skilled labor to intensify, especially as the market remains busy.”

Sectors that will require special attention include:

- manufacturing fit-out; mechanical, electrical, plumbing, and process piping

- cleanrooms

- lab case work

- structural steel

- large electrical gear.

Along with construction labor constraints, recruiting quality talent for capital delivery projects has become more difficult over the past three years. The type of talent required is changing. Companies will need to consider recruiting from nontraditional routes; this is becoming more relevant with an aging talent pool looking to retire and lack of younger talent entering the industry. Therefore, integration is more important for all parties.

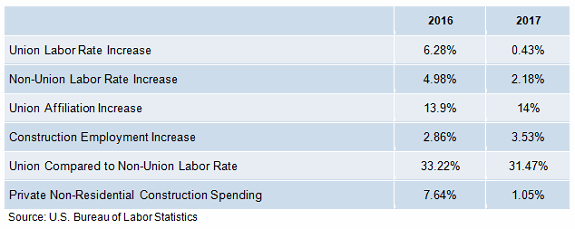

Table 3: Construction Market Indicators

While today’s market conditions do not allow for a long-term forecast, it is evident that if the current trend continues, the demand for the construction workforce will continue to exponentially increase the labor rate.

Proactive engagement and establishing long-term, performance-based incentive agreements will secure and retain the labor force. Organizing regional supplier forums to communicate upcoming projects will attract new entrants and diversified suppliers. Developing new contractors with small projects will help cultivate safety best practices. Foster business relationships with modular building and skid manufacturing vendors to save time, minimize disruption, and potentially reduce cost. The impact of new technology will require strategic long-term planning. It is not only about delivering a building, but also about how it will be operated. The average age of skilled construction workers in the U.S. is 55, while the entry rate of new skilled workers remains stagnant. It is essential to focus on developing a sustainable skilled workforce.

Conclusion

The construction sector is projected to be the fastest growing industry into 2020. Workers are turning to staffing companies to find reliable temporary work, and construction companies are relying on staffing agencies to reduce recruiting costs and ensure they have talented laborers. Demand increase for process equipment coupled with shortage of construction labor will require proactive engagement with vendors/contractors and greater due diligence to ensure predictable results. The following challenges and opportunities can result in improved and predictable project delivery results:

- Contractors are declining bids and requiring more time (+three weeks) to submit quotes. This is an opportunity to rethink the RFP process and promote early coordination with tier-one and -two contractors.

- Equipment vendor qualification and expediting will be critical to ensure predictable results. Early verification of vendor workload and shop capacity will be essential to secure achievable timelines.

- Aggressive timelines will increase risk to individual projects. There is an opportunity to spend more time on planning and prep work activities to deliver predictable results. VDC/BIM (virtual design and construction/building information model) is being chosen more often to increase productivity and shave weeks off the construction schedule.

- Adapting more-accommodating payment terms can provide incentives to attract and retain contractors.

References:

- www.constructionlabor.com/skilled-workers

- Pagliarulo, N. “Pharma tees up US Capital spending, yet details remain vague.” BioPharmaDIVE, Feb. 1, 2018.

- Slowey, K., Tyler March, M., Cowin, L. “8 construction trends to watch in 2018.” BioPharmaDIVE, Jan. 8, 2018.

- www.bls.gov

- Frangould, A. “As tech drives change in the construction industry, here’s what the future holds.” CNBC, Dec. 14, 2017.

- “January 2018 Manufacturing ISM Report on Business.” Institute of Supply Management, Feb. 1, 2018.

- “Turner Fourth Quarter Building Cost Index Reflects Strong Market Conditions.” Turner press release, Jan. 06, 2017.

About The Author:

Hector M. Samper is executive managing director of Diversified Global Systems-Integrated Project Services (DGS-IPS Joint Venture) and principal/strategic advisor of Global Strategic Sourcing Solutions (GSSS). Based in Bethlehem, PA, Samper recently partnered with DGS and IPS to form a joint venture (JV) with diversity in mind. The JV is certified by the National Minority Supplier Development Council (NMSDC) and focuses on delivering an integrated project approach specializing in technical, engineering, and construction management services to the biopharma sector. Samper has over 30 years of engineering, sourcing, and procurement experience in a number of sourcing categories across North America, Europe, and Latin America. His recent experience at Sanofi included creating and leading the strategic vendor management office for the global IT function and heading the North America operations and CAPEX procurement group. Prior to Sanofi, Samper worked for Amgen, Purdue Pharma, and Merck, where he held roles of increased responsibility in the engineering, global sourcing, and procurement organizations. Samper earned a bachelor’s degree in civil engineering from the New Jersey Institute of Technology. You can contact him at hmsamper@aol.com.

Hector M. Samper is executive managing director of Diversified Global Systems-Integrated Project Services (DGS-IPS Joint Venture) and principal/strategic advisor of Global Strategic Sourcing Solutions (GSSS). Based in Bethlehem, PA, Samper recently partnered with DGS and IPS to form a joint venture (JV) with diversity in mind. The JV is certified by the National Minority Supplier Development Council (NMSDC) and focuses on delivering an integrated project approach specializing in technical, engineering, and construction management services to the biopharma sector. Samper has over 30 years of engineering, sourcing, and procurement experience in a number of sourcing categories across North America, Europe, and Latin America. His recent experience at Sanofi included creating and leading the strategic vendor management office for the global IT function and heading the North America operations and CAPEX procurement group. Prior to Sanofi, Samper worked for Amgen, Purdue Pharma, and Merck, where he held roles of increased responsibility in the engineering, global sourcing, and procurement organizations. Samper earned a bachelor’s degree in civil engineering from the New Jersey Institute of Technology. You can contact him at hmsamper@aol.com.