3 Action Items For The US Bio/Pharma Industry To Mitigate Supply Vulnerabilities

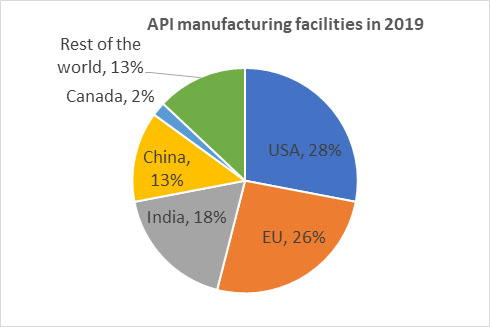

The United States is a leader in research and development of active pharmaceutical ingredients (APIs) and drugs; however, the U.S. is not a major manufacturer of medicines. According to this FDA study, 72% of the API consumed in the U.S. is made outside the U.S. The United States’ reliance on foreign manufacturers of API has been a known fact for several years. This vulnerability has existed in the U.S. drug supply chain had not received the attention it deserved until the COVID-19 pandemic brought increased attention and scrutiny to the U.S. drug supply chain’s reliance on foreign manufacturers.

The lack of drug manufacturing within the U.S. leads to risks of shortages and unavailability when the supply chain is disrupted and when foreign manufacturers quit making APIs.

A recent survey by U.S. Pharmacopeia (USP) underscored this problem, with 95% of U.S. physicians responding that the COVID-19 pandemic has revealed vulnerabilities in the medical supply chain that are not going away, and seven out of 10 (73%) feel their trust in the ability of the supply chain to deliver safe, quality medicines has eroded.

Source of data: FDA report

Below are three steps that could be taken to mitigate the vulnerability.

1. Perform A Thorough Risk Assessment

While drugs in general are critical, some are more critical than others. A short-term shortage of an ADHD drug and a short-term of shortage a drug administered in the ER have disproportionate impacts on public health. The industry as a whole should categorize drugs into three buckets: lifesaving, essential, and elective. First, start with the lifesaving drugs and complete a risk assessment. Risk assessments should consider the following parameters.

- Where are your API manufacturers located? Is there one or more manufacturer in the U.S.? Is the API only imported into the U.S.? Is the API made by a single manufacturer? While certain drugs may be essential, if it’s an API made by single manufacturer in foreign country, the drug is vulnerable to disruption for longer periods if the API manufacturer quits the business. So, such drugs should be considered high-risk as well.

- Where are your excipients coming from? A drug could have one to 10+ excipients. It is critical to document every excipient and if even one excipient is subject to vulnerability, the entire drug’s availability is vulnerable. This is an area that is often overlooked. For a drug to be available, it’s not enough to have the API alone; all the excipients (inactive ingredients) should be available as well. This necessity and complexity are often not discussed or are underestimated.

- What does historic drug shortage data tell you? FDA releases drug shortage reports. Drugs experience shortages for certain reasons that are typical and, therefore, drugs that have seen shortages more than one time could be considered high-risk. Drugs that are deemed lifesaving (e.g., used in critical care, trauma, etc.) and have ingredients – either API or excipients – that are single sourced or 100% imported should fall under the high-risk category.

2. Establish & Maintain A Strategic Stockpile Of “High Risk” Drugs

The government should establish a strategic national stockpile of essential medicines to ensure an adequate supply during emergencies or disruptions, and pharma companies, pharmacies, and wholesales should also have some reserves. Government bodies should be able to forecast demand and supply disruption scenarios to stock adequate amounts of high-risk medicines. Each medicine will have a specific shelf life and storage conditions. This will lead to maintaining a complex inventory system. However, the complexities will have to be managed to assure the supply of medicines during manufacturing and supply chain disruptions.

In addition to a government managed inventory, pharmaceutical companies should also have programs to monitor consumption and maintenance of a more than adequate inventory of medicines that fall into the high-risk category. FDA could facilitate and encourage collaboration between pharmaceutical companies, healthcare providers, pharmacies, and hospitals to maintain larger inventories and implement efficient inventory management systems. In addition, pharma companies should develop contingency plans for high-risk category drugs. The contingency plans could include:

- Alternative medications: For each high-risk category medicine, identify therapeutically equivalent dosages.

- Alternative formulations: In cases where there is no therapeutically equivalent dosage, invest in developing alternate formulations. For example, certain drugs may be marketed only in extended-release dosage form, but companies could consider developing an immediate release formulation in case of a shortage.

Segment your suppliers and identify suppliers of the high-risk category drugs. Manage suppliers strategically and maintain a constant and close relationship with them. Regular communication, collaboration, and transparency can help foster trust and enable better contingency planning. It is essential to have a clear understanding of the suppliers' capabilities, capacity, and potential risks they may face. While Asia has been the focus for imports into the U.S., the EU and Canada could be strategic partners for the U.S. in API supply. The U.S. should consider having strategic supply relationships with multiple countries, preferably in each continent to accommodate disruptions in logistics.

Engage with regulatory bodies and industry peers to share and gain insights and support during supply chain crises. Sharing best practices and lessons learned and publishing white papers jointly will help the entire industry to maintain a resilient supply chain.

3. Incentivize And Improve U.S. Manufacturing

Cost is the major reason that manufacturing of pharmaceutical ingredients is happening overseas. Countries such as India and China have lower-cost labor forces. About 31% of the APIs consumed in the U.S. comes from China and India. Subsidizing the manufacture of pharmaceutical ingredients in the U.S. will encourage domestic manufacturers to pursue pharmaceutical ingredient manufacturing. U.S. regulators could consider providing special grants for high-risk category drugs. Regulators should consider setting up Special Economic Zones (SEZs) for pharma ingredient manufacturing, which will allow for optimization of logistics, environmental, and cost factors.

While incentives, grants, and SEZs are meaningful incentives, improving the manufacturing efficiency of pharma ingredients will be the long-term solution. For the most part, pharma manufacturing is still batch process, which makes manufacturing labor-intensive and costly, particularly for U.S. manufacturing. While R&D is often talked about in drug development, manufacturing research is overlooked. An innovation forum should be set up to drive the move from batch process to continuous manufacturing. Collaboration between the government, industry, and academia to enable continuous manufacturing of pharma ingredients will go a long way to lowering the cost of production.

About The Author:

Rajendran (Raj) Arunagiri has been in the pharma industry for a decade and has successfully developed and launched a new excipient. He is a co-author of technical articles and is an invited speaker at conferences focused on excipients and drug delivery. Arunagiri welcomes you to reach out to him for questions, comments, and collaboration ideas at raj.gceb@gmail.com.

Rajendran (Raj) Arunagiri has been in the pharma industry for a decade and has successfully developed and launched a new excipient. He is a co-author of technical articles and is an invited speaker at conferences focused on excipients and drug delivery. Arunagiri welcomes you to reach out to him for questions, comments, and collaboration ideas at raj.gceb@gmail.com.