Biopharma In China: The Emerging Global Force Of Domestic Suppliers

By Vicky Xia and Leo Yang, BioPlan Associates

Quite a few Chinese biopharma companies are shifting their purchase of supplies from global multinational corporation (MNC) vendors to domestic vendors for their clinical stage projects via process changes, and many say domestic substitution would be more common if the National Medical Products Administration (NMPA) gets more lenient with process changes.

In fact, the long-term global impact may be that Covid creates new competitors in many segments. As delivery problems and availability bring supply chain risks to the surface, most end users are considering and validating alternative suppliers. Over the long haul, this will increase the number of supplier options. These availability and supply chain problems are creating additional political pressures in China. Interest in reducing reliance on global bioprocessing suppliers is being supported through subsidies and investments. Our research for this article is taken from BioPlan’s Top 60 Distributors of Bioprocessing Supplies in China,1 and we are seeing that the trend of domestic substitution is highly likely to continue.2,3

The sector is dominated by MNCs, including Thermo Fisher, Merck, Cytiva, and Danaher, who have ~90% of the total market share globally. In China, domestic vendors are estimated to have already captured over 20% of the Chinese market share for certain consumables, such as buffers, and cell culture media. The pandemic has enabled domestic vendors to make inroads during the supply shortages experienced by MNC vendors.

Although MNC vendors have seen double-digit pandemic-related sales increases for bioprocessing supplies, the top domestic vendors have posted even higher growth rates since the pandemic. While domestic suppliers are starting from a much smaller baseline, this growth trend is likely to continue. Most industry insiders believe domestic vendors will retain their market share and continue to grow after the pandemic. What is driving this growth is customers’ recognition that Chinese consumables suppliers are offering quality, consistency, and documentation that is considered “acceptable.” And with prices significantly cheaper than those of their MNC counterparts, segments of the Chinese market are finding this enough to evaluate and switch.

Price Pressures On Chinese Biomanufacturers

A major factor in the emerging domestic competition is the Chinese drug industry’s response to cost pressures being implemented, such as the volume-based procurement (VBP) policy. These programs aim to lower consumer prices and will put pressure on manufacturers to lower overall costs.

The VBP program, while pushing for price reduction of biopharmaceuticals, is also expected to increase market demand for reagents. As profit margins decrease, some developers are shifting to larger stainless-steel bioreactors. Many projects using supplies from MNC vendors are going into commercial-scale production, and a portion of them will stick with their current vendors because process changes can be time-consuming and costly under the current regulatory framework.

China Remains An Attractive Market For MNC vendors

Despite the increasing competition from domestic vendors, China remains an attractive, important market for MNC vendors. China is quickly expanding or upgrading its bioprocessing capacities, due to a wave of mAb biopharmaceutics obtaining Biologics License Applications (BLAs), and entering into commercial-scale production, market demand for vaccines boosted by pandemic, as well as cell and gene therapy developers planning for new capacity. Our research shows that China will grant at least 10 BLAs to mAb therapeutics per year over the next five years.

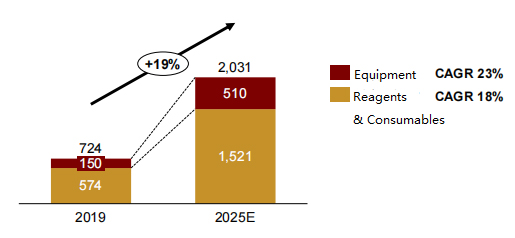

Analysts project that the overall life science and bioproduction supplies market will increase from RMB 72.4 billion (USD $11.3 billion) in 2019 to RMB 203.1 billion (USD $31.9 billion) in 2025 at a CAGR of 14%. The reagents and consumables market for commercial scale bioprocessing will grow from RMB 57.4 billion (USD $9 billion) to RMB 132.8-171.4 billion (USD $20.8-26.9 billion) in 2025 (Fig 1). 1

Figure 1: China Commercial Scale Bioprocessing Supplies Market Poised for Strong Growth1

Unit: hundreds of millions of RMB

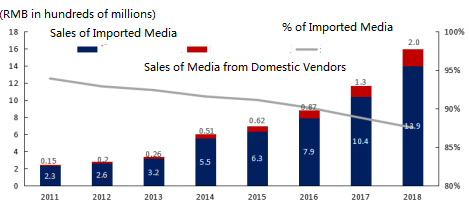

Though domestic vendors have been encroaching on MNCs’ market share recently, this trend does not mean MNC vendors will not see strong growth, as witnessed by China’s cell culture media market data (Fig 2).2 Here, the percentage of imported media was nearly 95% 10 years ago. The import percentage today is around 80%, and will continue to decline, following this 10-year trend.

Figure 2: China Cell Culture Media Market2

MNCs Have A Relatively Strong Position

BioPlan studies have found that although domestic vendors are capturing market share for consumables, including single-use products (bags and tubes), cell culture media, and even sterilization filters and resin, MNC vendors continue to be well positioned in the eyes of biopharma companies.

Domestic vendors, for example, may only be able to offer lower costs for a handful of key products. MNCs, which have much more complete product portfolios covering both upstream and downstream bioprocessing, will be able to bundle products attractively. For example, most industry insiders believe it will be difficult for domestic vendors to provide hardware equipment, especially analytics equipment.

Hardware equipment (including stainless-steel bioreactors), single-use bioreactors, and single-use bags need to be in direct contact with proteins, advanced filtration systems (in-depth filtration, ultra-filtration, nano-filtration, etc.), and systems that need software for control, automation and digitization systems, etc. These remain relative strongholds for MNC vendors, though domestic peers are making efforts to catch up.

Most Chinese facilities tend to avoid purchasing stainless-steel bioreactors from domestic vendors. However, observers are projecting that domestic substitution will take place even in this segment within a decade. Tools for Six Sigma and lean manufacturing provide advantages for MNC vendors. And bioprocessing consumables for cell and gene therapy are also monopoly areas for MNCs. But Chinese end users would like to see domestic vendors enter into these subsectors as well, and this will continue to create competition.

Domestic vendors may compete on price (their products can be priced at half of an MNC vendors’ price), MNC suppliers retain key advantages:

- Good reputation and track record with regulatory authorities. The major MNC vendors have been in the bioprocessing equipment/supplies industry for decades, and they have numerous successful cases with regulatory authorities around the world. Even Chinese biopharma companies, who are relatively price sensitive, state that products from MNC vendors are their first choice when they demand very fast development. The lack of track record is also a key weakness of domestic vendors, who are relatively young and still need time to build up their reputations. However, with the exporting ambition of Chinese developers on the rise, MNC vendors may not be able to maintain the monopoly on supplies of made-in-China biopharmaceuticals heading to overseas markets.

- Good quality. MNC vendors are known for their good quality systems, economies of scale, as well as the stability of their quality (less between batch differences), while between-batch differences remain an issue with domestic vendors, which may partly be due to less automation during the manufacturing process. Many users have complained that the trial products from domestic vendors offer good cost-effectiveness, but not every batch meets quality demand. As a heavily regulated industry, quality is and will always be clients’ first concern. This is also the reason many Chinese biopharmas do not use supplies that need to be in direct contact with protein products from domestic vendors.

- Strong capability in innovation/new product development. MNC vendors of bioprocessing supplies have long been the leaders in innovation, while most domestic vendors focus on generic versions of products from MNC peers. Though MNCs can try other routes to increase cost-effectiveness of their products, innovation is ultimately where domestic vendors will have much difficulty in catching up. However, often it is patented innovation rather than trade secrets that matter, given China’s high staff turnover rate.

- Business stability is a key strength of MNC vendors. Domestic vendors are all relatively young, with most of them only a few years old. Clients have concerns about whether they will be in the business for the long run and whether they are committed to producing the products they have launched, as abrupt changes in operation can lead to supply chain issues for clients.

- Complete product portfolios. Major MNC vendors, such as Cytiva, Thermo Fisher, and Sartorius, offer total solutions for bioprocessing from R&D to commercial production; this increases customer loyalty.

Conclusions

Domestic substitution is sweeping consumables subsectors in bioprocessing supplies. Some industry analysts project that once domestic suppliers get on their clients’ supplier lists, they will dominate China’s bioprocessing supplies markets. Some predict this may occur within a decade. However, the future depends on how MNC vendors react to current competition. MNC vendors will need to take the following steps to maintain their market share:

- Increase local manufacturing, local technical support, and local product development. Local technical support enables more timely services, while local manufacturing can address concerns of supply chain stability and lead time.

- Increase local customized product development. Cytiva, Merck, Millipore, and Pall have established local manufacturing sites for single use products over the past two years.

- Innovative products/solutions (better with patent protection) are also necessary. While domestic vendors have relied on relatively cheaper labor to increase cost-effectiveness, MNCs can leverage innovation to create more efficient and cost-effective solutions.

There is room for improvement in bioprocessing efficiency, from monitors/sensors, automation, and digitization to Protein A resin, etc. The industry is waiting for innovative products from MNC vendors; through innovation and better technology, MNCs can maintain their leading role while Chinese vendors work to catch up.

References

- Top 6o Distributors of Bioprocessing Supplies in China, BioPlan Associates, June 2020.

- Framework of supplies for Life Science and Biopharma Industry, China Merchants Securities

- China Life Science and Pharma supplies industry analysis, Industrial Securities

About the Authors:

Vicky (Qing) Xia is the senior project director at BioPlan Associates. She has an MS in biology from University of Texas-Houston and an MBA from the University of Pittsburgh. She has experience in consulting and business development, as well as alliance management in China’s biopharmaceutical industry. Her expertise includes developing research and analysis on multiple global market segments, and she has managed a team of industry experts and projects. She can be reached at vxia@bioplanassociates.com, +1 301-921-5979, www.bioplanassociates.com.

Vicky (Qing) Xia is the senior project director at BioPlan Associates. She has an MS in biology from University of Texas-Houston and an MBA from the University of Pittsburgh. She has experience in consulting and business development, as well as alliance management in China’s biopharmaceutical industry. Her expertise includes developing research and analysis on multiple global market segments, and she has managed a team of industry experts and projects. She can be reached at vxia@bioplanassociates.com, +1 301-921-5979, www.bioplanassociates.com.

Leo (Cai) Yang, project manager at BioPlan Associates, has business development experience in the biotech and pharma segments and 10 years of experience in market research. He graduated from East China Normal University with a BA in biotechnology in 2006 and has worked with equipment manufacturers in the pharmaceutical and medical device industries in Switzerland, Austria, and Germany. He has also managed studies involving new biopharmaceutical technology applications in China, including analysis and strategy development. He can be reached at lyang@bioplanassociates.com, +1 301-921-5979, www.bioplanassociates.com.

Leo (Cai) Yang, project manager at BioPlan Associates, has business development experience in the biotech and pharma segments and 10 years of experience in market research. He graduated from East China Normal University with a BA in biotechnology in 2006 and has worked with equipment manufacturers in the pharmaceutical and medical device industries in Switzerland, Austria, and Germany. He has also managed studies involving new biopharmaceutical technology applications in China, including analysis and strategy development. He can be reached at lyang@bioplanassociates.com, +1 301-921-5979, www.bioplanassociates.com.