Bioprocessing Year In Review: 11 Key Trends Accelerated By COVID-19

By Ronald A. Rader and Eric S. Langer, BioPlan Associates, Inc.

Over the past 17 years we have identified a number of trends that are impacting bioprocessing and biopharmaceuticals  manufacturing, the majority of which have promised positive outcomes. With the COVID-19 crisis, many of these ongoing trends have been accelerated.

manufacturing, the majority of which have promised positive outcomes. With the COVID-19 crisis, many of these ongoing trends have been accelerated.

Although it seems we may now be seeing the light at the end of the COVID tunnel, some of the effects of the pandemic on bioprocessing and vaccines manufacturing may result in permanent changes.

Major concerns, even pre-pandemic, were continued cost-cutting and often related mergers and acquisitions, but even this trend appears to be slowing. Staffing problems, on the other hand will only get worse, especially with rapid growth in foreign bioprocessing and new cellular and gene therapies-associated capacity.

In this year’s 17th Annual Survey and Review of the bioprocessing sector,1 we identified the following ongoing trends in 2020, and these are likely to continue to top the list in 2021. When you consider the impact the pandemic has had on global populations, many of these trends will benefit future planning for public health strategies:

- Increased number of global biopharma facilities

- Expanded biological product possibilities, but often with smaller markets

- Wider range of follow-on products and manufacturers of biosimilars and biogenerics

- More flexibility in facility design, bringing more modular facilities online

- Continued adoption of single-use systems at research, clinical, and commercial scales

- Improved bioprocessing efficiency with titers and yields continuing to increase

- Escalating use of continuous processing, including at the downstream end

- Multiplying opportunities in high-tech expression systems and other genetic advances

- Further automation, monitoring, and process control

- Broader use of bioprocess modeling, including focusing on downscaling

- More and more complex regulations.

These and other trends affecting the bioprocessing sector are familiar to most and have continued for years. These trends are essentially all bioprocessing/biopharmaceutical industry-related, driven primarily by continuing advances in technology and industry expansion; they have been extensively discussed in BioPlan Associates’ annual surveys and reviews of the bioprocessing sector.

Because the COVID-19 pandemic has so strongly affected essentially every aspect of business and individual activities and plans worldwide, we start our analysis of trends in context here.

Impact Of COVID-19 Pandemic

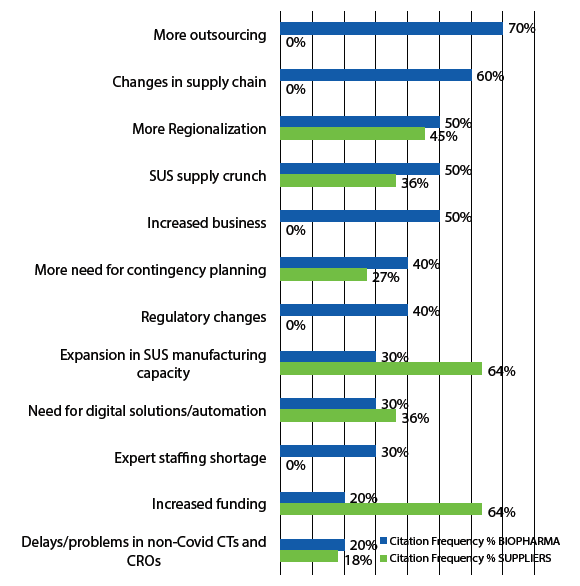

COVID-19 and, particularly, industry responses to the pandemic, were clearly the biggest news in 2020, affecting almost every aspect of the biopharmaceutical industry. For the bioprocessing sector, this has nearly exclusively involved acceleration of already ongoing trends, as noted above, essentially all of which are having positive outcomes. This was confirmed by an extensive interview-based study performed by BioPlan Associates in mid-2020 to supplement the result of the annual survey, early in the pandemic. Results from developer and supplier company interviewees citing expected long-term effects on bioprocessing are shown in Figure 1.

Overall, bioprocessing executives/managers reported rapid adaptation to pandemic-related changes in personal and corporate behavior, including social distancing and more work being done off-site, while manufacturing and R&D continued mostly undisrupted – and often increasing – with biopharmaceuticals considered an essential industry. This includes almost every bioprocessing supplier seeing increased sales, including most of the very largest suppliers now reporting up to 20% or even more growth in sales vs. 2019. Similarly, CMOs are seeing increased business as companies either outsource all or parts of their COVID-19-related projects and/or outsource other projects now considered less important.

Fig 1: Long-term Effects of COVID-19 on Bioprocessing

In 2020, most activities, including R&D, bioprocessing capacity, and markets, were not being cut back; rather, they were being further accelerated. This includes on the order of $10 billion new investments in the biopharmaceutical industry, most of which were to bring new and expanded manufacturing capacity online and expand product development pipelines with pandemic-related products, often with major investments in new facilities and R&D. The biopharmaceutical industry has stepped up and is doing its part, including rapidly implementing COVID-19 vaccine- and therapeutic-related R&D and manufacturing programs and related facilities construction.

Developer companies are bringing multiple likely successful vaccines candidates online in record time – less than a year – and are scaling and ramping up their manufacture in record time. This includes manufacturing tens of millions of finished doses “at risk,” while pivotal trials are still ongoing and before FDA and other approvals can be attained. Ultimately, countries worldwide will be the parties purchasing and distributing, often free, the resulting COVID-19 vaccines and therapeutics, but it is industry, not governments, that has developed the products and is bringing them to market, often with no plans to make a profit from the pandemic.

To illustrate how the pandemic has affected the bioprocessing sector, each of the ongoing trends is discussed briefly below in the current pandemic-dominated context:

1. Increased number of global biopharma facilities: After seeing disruptions and identifying weaknesses in their supply chains, both bioprocessing and supplier companies are moving to further disseminate product manufacturing worldwide, with more manufacturing facilities in more regions serving regional markets and acting as backup/second sources for other manufacturing facilities.4 For example, there will tend to be more facilities coming online in China, the U.S., and Western Europe to serve these specific markets. This will further accelerate the trend for more and smaller bioprocessing facilities.

2. Expanded biological product possibilities, but often with smaller markets: The pandemic has clearly expanded the number and types of products in the development pipeline, including products based on entirely new technologies, such as RNA vaccines. The trend toward smaller markets, such as more orphan products, will continue. But industry response to the pandemic is totally different, with unprecedented universal markets for new products. Essentially every individual worldwide will likely need multiple vaccinations to maintain immunity, requiring manufacture of an additional ≥10 billion doses of vaccines/year in addition to current needs.

3. Wider range of follow-on products and manufacturers of biosimilars and biogenerics: This trend for more follow-ons – biosimilars, biogenerics, and biobetters – is continuing and likely being accelerated as more companies enter biopharmaceutical development, often by initially targeting pandemic-related products. Also, there are increased opportunities worldwide as most of the current market leaders – those already with the most reference and biosimilar products – are preoccupied with bringing pandemic vaccines and therapeutics to market.

4. More flexibility in facility design, bringing more modular facilities online: Flexibility in bioprocessing has now become even more critical. This includes facilities’ ability to manufacture multiple products, often at different scales, including rapid switchovers to making other products, more rapid construction, and bringing fully validated facilities online, along with reduced need for capital investments, etc. Particularly as pandemic vaccine and therapeutics manufacturing is disseminated to identical cloned facilities worldwide, there will be an increase in modular construction and use of prefabricated modular units.

5. Continued adoption of single-use systems at research, clinical, and commercial scales: Along with increasing facility flexibility, there will be even more use of single-use systems. Already, single-use is hitting its upper limits for precommercial manufacturing, with BioPlan estimating that 85% of preclinical and clinical manufacturing is now single-use. Much of this expansion of single-use will involve adoption of ≥2,000 single-use bioreactor-based process lines for commercial manufacturing, including scaling out with multiple bioreactors or whole process lines operating in parallel, rather than traditional scaling up using large stainless steel bioreactors and process lines. Many, if not most, of the new pandemic products’ manufacturing facilities coming online worldwide – many of which would formerly have been stainless steel – will be single-use-based.

6. Improved bioprocessing efficiency with titers and yields continuing to increase: This is a relative outlier, among the few ongoing bioprocessing trends not being significantly accelerated as industry responds to the pandemic. As noted below, there will be more use of novel, often more efficient, expression systems.

7. Escalating use of continuous processing, including at the downstream end: Continuous upstream perfusion and downstream continuous chromatography will see even more accelerated adoption in coming years, with continuous processing complementing the increasing need for bioprocessing flexibility. Besides offering lower costs, continuous manufacturing will enable process lines and facilities to be smaller and more rapidly brought online with less capital investment.

8. Multiplying opportunities in high-tech expression systems and other genetic advances: The need to rapidly expand manufacturing volume and reduce costs to provide vaccines and therapeutics to most everyone will result in increased adoption of expression systems beyond the usual CHO and E. coli. This will likely include increased adoption of plant, insect, novel mammalian, and microbial host cell lines and, eventually, synthetic biology/cell-free systems. Manufacturers needing to produce often unprecedented large numbers of doses/product units will be adopting non-CHO and non-E. coli expression systems.

9. Further automation, monitoring, and process control: With the pandemic, there is even more interest in and motivation to adopt increased automation of bioprocessing, often with the goal of reducing or even eliminating on-site staff. High levels of automation will be adopted in many of the new pandemic product-associated bioprocessing facilities coming online, with automation simply needed to attain required manufacturing capacity and reduce costs and time to market.

10. Broader use of bioprocess modeling, including focusing on downscaling: As more world-class super-size and large numbers of smaller facilities come online worldwide for pandemic-associated product manufacturing, and as scales of manufacturing often increase, the importance of bioprocessing modeling will increase, particularly including models to downscale processes. Validated downscaling, along with more traditional upscaling, ability is needed to enable process design, testing, and validation at smaller rather that full scales. For example, culture media to test upstream processing at full commercial scale potentially costs millions of dollars. And downscaled processes are needed to demonstrate viral inactivation (vs. at full scale) and otherwise show regulators adequate understanding and control of bioprocessing.

11. More and more complex regulations, a most certain trend: There will be pandemic-associated regulatory changes. Many will be related to accelerating product development, approvals, and distribution.

Conclusion

As noted by one of the respondents to our mid-2020 interview-based study, “The industry has been part of the pandemic and biodefense response for decades.” The industry has, in a way, been preparing for this situation for many years. Despite the morbidity, deaths, and terrible societal disruptions associated with the COVID-19 pandemic, 2020 will have created something of a positive outcome for the bioprocessing sector. Most prior trends affecting the bioprocessing sector, nearly all of them positive and involving progress or growth, have been accelerated by industry responses to the pandemic (not the pandemic itself). These accelerated trends will continue at least for the near term as pandemic-associated bioprocessing rapidly increases worldwide. And the bioprocessing industry will certainly be at the center of discussions for how future pandemics will be addressed.

What will the top bioprocessing trends of 2021 be? Share your thoughts by participating in the online survey for BioPlan’s 18th Annual Global Biopharmaceutical Manufacturing Study.

References:

- Langer, E.S.., et al., BioPlan Associates, 17th Annual Report and Survey of Biopharmaceutical Capacity and Manufacturing, BioPlan Associates, April 2020, 528 pages (see www.bioplanassociates.com/17th).

- Covid-19 Impact on Bioprocessing, BioPlan Associates, 16 pages (at https://bioplanassociates.com/reports-studies/covid-19-impact-on-bioprocessing-white-paper-bioplan-20200605/).

- Rader, R.A. and Langer, E.S., Top 1000 Global Biopharmaceutical Facilities Index, BioPlan Associates, www.top1000bio.com.

About the Authors:

Ronald A. Rader is senior director of technical research at BioPlan Associates, Inc. He has 35+ years’ experience as a biotechnology and pharmaceutical — particularly biopharmaceutical — information specialist, analyst, and publisher, and he has been responsible for the Antiviral Agents Bulletin periodical, the Federal Bio-Technology Transfer Directory, BIOPHARMA: Biopharmaceutical Products in the U.S. and European Markets, and the Biosimilars/Biobetters Pipeline Directory. You can reach him at rrader@bioplanassociates.com or (301) 921-5979.

Ronald A. Rader is senior director of technical research at BioPlan Associates, Inc. He has 35+ years’ experience as a biotechnology and pharmaceutical — particularly biopharmaceutical — information specialist, analyst, and publisher, and he has been responsible for the Antiviral Agents Bulletin periodical, the Federal Bio-Technology Transfer Directory, BIOPHARMA: Biopharmaceutical Products in the U.S. and European Markets, and the Biosimilars/Biobetters Pipeline Directory. You can reach him at rrader@bioplanassociates.com or (301) 921-5979.

Eric S. Langer is the president and managing Partner at BioPlan Associates, Inc., a biotechnology and life sciences marketing research and publishing firm established in Rockville, MD, in 1989. He is editor of numerous studies, including Biopharmaceutical Technology in China, Advances in Large-scale Biopharmaceutical Manufacturing, and many other industry reports. You can reach him at elanger@bioplanassociates.com or (301) 921-5979.

Eric S. Langer is the president and managing Partner at BioPlan Associates, Inc., a biotechnology and life sciences marketing research and publishing firm established in Rockville, MD, in 1989. He is editor of numerous studies, including Biopharmaceutical Technology in China, Advances in Large-scale Biopharmaceutical Manufacturing, and many other industry reports. You can reach him at elanger@bioplanassociates.com or (301) 921-5979.