Biosimilars Pipeline Analysis: Many Products, More Competition Coming

By Ronald A. Rader, BioPlan Associates, Inc.

To date, more than 20 biosimilars have entered European markets. And while only two biosimilars have received FDA approval in the U.S. thus far, more are on the way. Further, a large number — up to several hundred — of what might be called “biogenerics” from lesser- and non-regulated regions are in international commerce or are in the pipeline. These generally do not meet Western GMP standards nor undergo rigorous biosimilarity evaluations. Our discussion of biosimilars in this article will center on developed-market GMP biosimilars. In the European market alone, biosimilars already are a multibillion-dollar business, and one that is rapidly growing.

approval in the U.S. thus far, more are on the way. Further, a large number — up to several hundred — of what might be called “biogenerics” from lesser- and non-regulated regions are in international commerce or are in the pipeline. These generally do not meet Western GMP standards nor undergo rigorous biosimilarity evaluations. Our discussion of biosimilars in this article will center on developed-market GMP biosimilars. In the European market alone, biosimilars already are a multibillion-dollar business, and one that is rapidly growing.

The U.S. is expected to be the biggest market for biosimilars. However, the FDA is yet to issue many basic, needed guidance documents on biosimilars — and has only approved two products — so much regulatory uncertainty exists.

Our Biosimilars Pipeline database shows a very healthy pipeline of biosimilar products in development, with the great majority targeted for the U.S., EU, and other major markets. This pipeline includes nearly 800 biosimilars and about 500 biobetters in development, a total of nearly 1,300 follow-on products in the development pipeline for over 100 currently marketed biopharmaceutical reference products.

In addition to biosimilars, approved based on biosimilarity with an already-marketed products, another class of biologics — biobetters — involves much the same active agent but in a new chemical or physical form and often a different delivery system. As such, biobetters require a full FDA approval, not the abbreviated biosimilar approval. Biobetters usually involve some innovation, while biosimilars are restricted to emulating older, off-patent products.

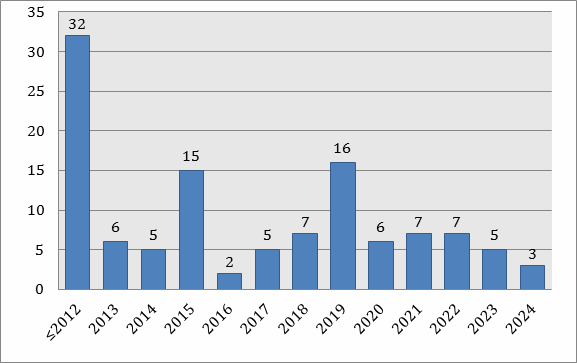

Figure 1 shows the number of biosimilars in the development pipeline by U.S. launchable dates. Ability to launch requires that all government-granted marketing exclusivities related to the biosimilars reference product are expired upon product launch — both relevant patents and regulatory-granted market exclusivities, including orphan status and 12-year data exclusivity granted to all new full biologics license applications (BLAs).

Figure 1: U.S. biosimilars launchable dates by reference products (n = 133)

Based on reference product marketability/launchability, we see a wave of initial approvals starting now and expect another major wave towards the end of the decade, when more products come off patent. The real prizes will be biosimilar versions of the many current blockbusters, mostly monoclonal antibodies. These are starting to come off patent now, along with often-interfering manufacturing patents, such as the Cabilly-Boss patents held by Genentech/Roche. These patents, which broadly (claim to) cover most conventional recombinant antibody manufacture, expire in 2018 in the U.S.

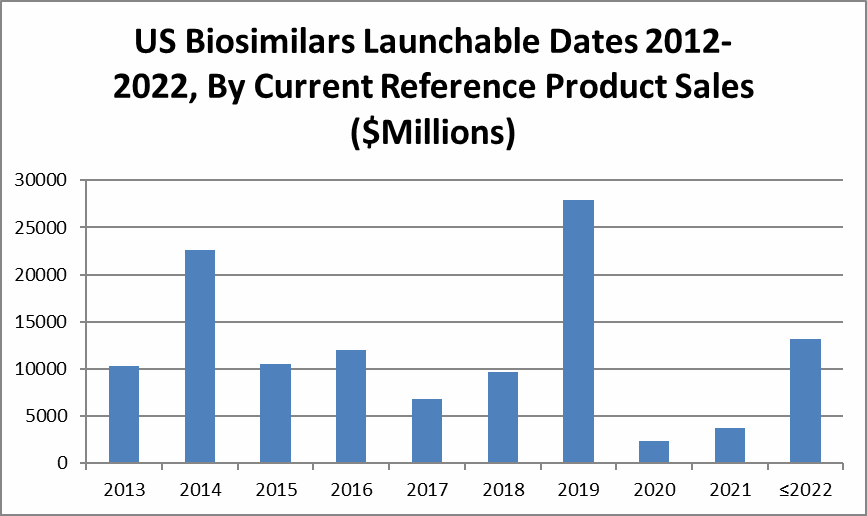

The projected economic impact of biosimilars is shown below in Figure 2, which demonstrates the magnitude of cumulative current reference product sales by the year these products are likely to enter the U.S. market. The biosimilars market is not and will never be a zero-sum game. That is, the introduction of biosimilars and other competing products result in a decrease in sales for all of the related products. Biosimilars will generally launch in the U.S., Europe, and other major markets at a discount — currently about 25% to 30% but fully expected to be about 50% in several years — and I expect reference products to be discounted to better compete with biosimilars. So, a biosimilar launch results in a contraction of markets or revenue for the reference and its biosimilars. Keep in mind that biosimilars must compete not only with their reference products and with other biosimilars, but also with other me-too products targeting the same indications, including existing and new innovative products and partially innovative biobetters.

Figure 2: Economic impact of biosimilars in the U.S., by launch date

A major factor affecting the evolution of the biosimilars market in the coming years will be the number of competing products and companies. This will be a rather new trend in the biopharmaceutical industry. Already, many leading biopharmaceutical product companies, nearly all of which manufacture major reference products, are and will continue to be among the first to develop new biosimilars for the U.S. and other major markets. This is contrary to what many experts originally projected years ago, and continues to be counter-intuitive to many. However, of the trend is due largely to clinical trials, of which the few to date have been conducted mostly by Big Pharma biosimilar developers. This pattern of Big Pharma pioneering most biosimilars development and marketing in the U.S. and other major markets will likely continue at least through the rest of this decade.

We have found that biosimilar developers, in general, are unaware of their upcoming competition, both in terms of products and companies targeting developing biosimilars of their reference products. Table 1 shows the number of biosimilars currently known to be in development for a few leading reference products.

Table 1: Number of Biosimilars in the Development Pipeline for Some Major Reference Product and Classes

|

Reference Product |

Biosimilars in Pipeline |

|

Epoetins, alfa |

79 |

|

Interferon, alfa |

70 |

|

Humira |

65 |

|

Neupogen |

58 |

|

Insulin and analogs |

51 |

|

Monoclonal antibodies |

227 |

|

Cancer as an indication |

428 |

Based on the above and other information, BioPlan projects an eventual average of 10 — or potentially even more biosimilars —competing in the U.S. and other major markets in coming years. Not all these competitive products will be successful, and by slicing up the market for a drug 10 ways, the profitability of each biosimilar will be significantly reduced. Biosimilar approvals will become rather routine, and biosimilars will likely outnumber marketed reference products by the end of the decade. Thus, it will be rare for any single biosimilar product to capture and hold ≥20% of the biosimilars market (for each reference product).

With all of this expected competition, will the market for biosimilars ultimately be profitable? Yes! We, along with many developers, project it definitely will be. In general, most biosimilars are expected to have development costs of ≤$100 million, compared to ≥$2.8 billion now for innovative biopharmaceuticals, with markets likely lasting a decade or more. A biosimilar that captures 10% market share of a reference product with a $1 billion/year market — a relatively minor blockbuster antibody, by current standards — could generate ~$50 million/year in revenue, even assuming a 50% discount over the reference product. Most biosimilars will be part of their marketing company’s broader portfolios of biosimilars, usually to complement other, more important products in order to maintain or extend the companies’ portfolio market shares. In this context, with no basic or other research required (just development efforts), biosimilars will be rather profitable for their manufacturers and marketers for years to come.

About The Author

Ronald A. Rader is senior director of technical research at BioPlan Associates, Inc. He has over 25 years’ experience as a biotechnology and pharmaceutical information specialist and publisher, including as editor/publisher of Antiviral Agents Bulletin, editor in chief of the journal Biopharmaceuticals, and many data resources, including Biopharmaceutical Products in the U.S. Market, now in its twelfth edition and the first biosimilars database.

BioPlan Associates Biosimilars Resources

BioPlan Associates has developed a suite of biosimilars-related information resources intended to be the leading biotechnology-grounded tools in this area. This includes the Biosimilars/Biobetters Pipeline Database, currently online at biosimilarspipeline.com. And much like its Top 1000 Global Biopharmaceutical Index (top1000bio.com), which reports estimated capacity at over 1,000 biopharmaceutical manufacturing facilities, BioPlan is developing a website tracking biosimilars manufacturing facilities worldwide. These databases complement the BIOPHARMA: Biopharmaceutical Products in the U.S. and European Markets database at biopharma.com, which includes launchability data (patent, data and orphan exclusivities, expirations) for over 130 currently approved reference products.

For more information, contact BioPlan Associates, Inc. at 301-921-5979 or www.bioplanassociates.com.