Biotech's Market Outlook In 2023 & Beyond

By Steve Kemler, life sciences senior analyst, RSM US LLP

Last year was a transition year for biotech companies. After massive investment, cheap capital, and public accolades for companies developing Covid treatments and vaccines during the pandemic, 2022 saw the initial public offering market grind to a halt and a slowing of new drug approvals. Now, as the biotech sector prepares plans for the remainder of this year, companies are faced with continued uncertainty. However, with these challenges and uncertainty come numerous opportunities for companies that are adequately capitalized.

There are three key themes in 2023 that are likely to have an outsized impact on the business decisions of life sciences leaders:

- Changes in interest rates by the Federal Reserve will impact investors’ risk appetite and the valuations that companies can expect in public and private markets.

- Labor will continue to be a challenge, but deeper struggles in other industries will present opportunities.

- The increase in competition from biosimilars and bioequivalents will force companies to write new playbooks for defending their incumbent drugs and the success, or failure, of those strategies will create the landscape for investment in biologics for years to come.

Let’s delve into each of these three trends a little deeper and then examine the key longer-term trends shaping the space beyond 2023.

Interest Rates And Valuations

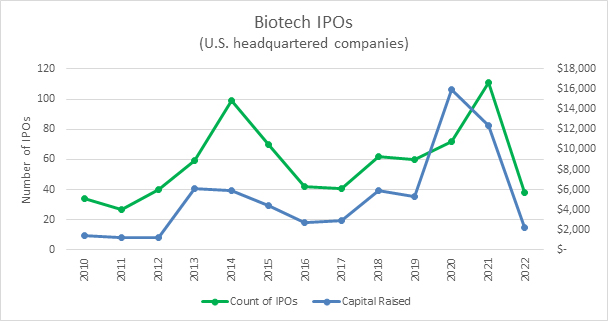

As always, the biggest question on the mind of biotech companies is how their candidates will do at each step along the way toward approval. This year, the next question among private biotechs seems to be when the IPO window is likely to reopen. The best way to understand that question is to look at the expectations for the U.S. federal funds rate.

Source: Bloomberg, RSM US LLP

Current estimates are that the Federal Reserve will continue to raise rates through the first half of this year. As interest rates are raised and remain high, the value of risky assets like biotech stocks tend to be depressed. This is especially challenging for companies that raised capital at a high valuation during the prior low interest regime and are now struggling to raise capital at valuations that are palatable for the existing investors. With inflation still high, executives should expect interest rates to remain elevated for an extended period as the Fed pushes for inflation to fall back toward its 2% target. Analysis by RSM suggests that companies should expect the IPO market to remain depressed for at least one to two quarters after the Fed’s last interest rate raise. Our expectation is that the Fed will raise rates in March and May, which means IPO activity could remain depressed through much of the year.

Source: Pitchbook, RSM US LLP

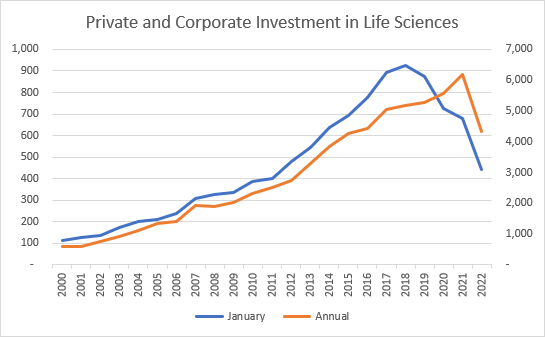

With this context, it should be no surprise that companies have struggled to raise capital in January of this year, whether through private equity (PE), venture capital (VC), or mergers and acquisitions (M&A). This slow start should be balanced with two facts: the amount of undeployed capital at PE and VC firms remains as high as ever and the managers of these funds are incented to put it to use by making investments. Additionally, the largest pharma companies had over $90 billion in cash or cash equivalents at the end of 2022. Those same companies also face the unending march of drugs toward their loss of patent protection and will face increasing pressure to deploy that cash to refill their research and development pipelines.

Finally, the increased interest rates and higher cost of capital will need to be considered as biotechs make numerous decisions on how to deploy their cash reserves. The supply chain challenges during the pandemic caused many companies to look at opportunities to bring their supply chains onshore or near shore. However, as capital becomes more expensive, the incremental costs of drug manufacturing in the United States will become harder to defend or afford.

Labor Remains Competitive

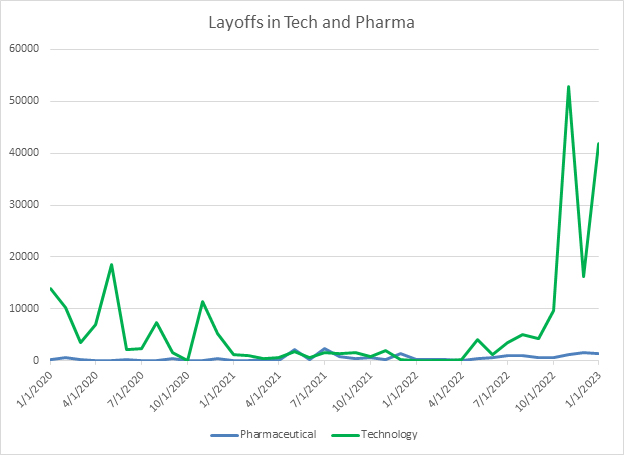

For years, the competition for talented life sciences employees has been fierce. As of the January jobs report released on February 3, the unemployment rate in the United States has hit a 50-year low at 3.4%. This means that attracting skilled talent to life sciences will remain difficult. However, the challenges facing other industries, especially technology companies, give life sciences companies the chance to make opportunistic hires as tech companies face layoffs and talented employees come briefly onto the market. However, it is important to note that overall employment in the technology industry is largely flat now. One important additional note is that, although there is a steady drumbeat of headlines about layoffs in the biotech space, when looking at the overall level of layoffs in the industry, they remain near annual trends and don’t show the same sharp uptick as some other industries.

Source: Challenger, Gray and Christmas, RSM US LLP

This places biotech executives in a tenuous position. They need to be careful stewards of their existing cash, while also being opportunistic and making strategic hires as people with less common skills in data analysis, programming, and artificial intelligence come onto the market as tech companies enact layoffs. However, since the overall level of employment in tech is largely staying steady despite these layoffs, biotechs need to be prepared to act quickly and make hires before other tech companies snap up these resources. Additionally, as the labor market stays very competitive, executives need to continue asking hard questions about where they want to invest attention to recruit and make hires, and where they will choose to outsource other roles. Choosing to outsource some of these functions gives companies much more flexibility in uncertain times to scale them up or down.

Biosimilars Continue To Make Inroads

This year stands to be a potential turning point for biosimilars and bioequivalents. Although each year has seen more biosimilars coming onto the market, 2023 represents one of the first times they are taking on a true blockbuster drug. These challenges will not go undefended, and the response mounted to protect this drug will serve as a template for other companies to follow as additional biosimilars come to market. If successful, the value of biologics in the development pipeline will increase and could create the opportunity for biotechs to raise additional capital.

According to research by IQVIA, 10 currently marketed biologic drugs will be facing competition from approved biosimilars that are expected to launch in 2023. Their research suggests that biosimilars could save $129 billion over the next five years. If successful, this represents meaningful savings for patients and payers – and a substantial risk to revenues for the biotech companies that developed the novel molecules.

Key Longer-term Trends

While this year is looking to be another challenging environment for biotech companies, it is also important to keep an eye on the longer-term changes that will impact biotech companies in 2024 and beyond. These include the shift to biologics, accelerated approval scrutiny, and pricing pressures.

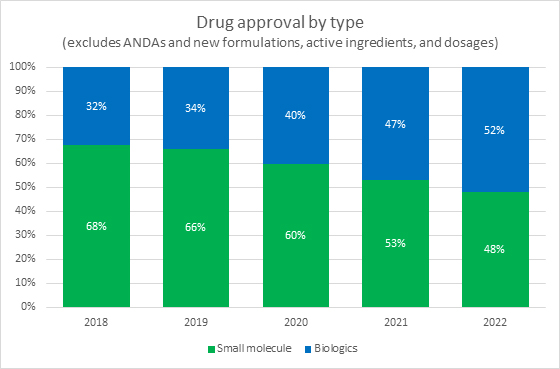

Source: FDA, RSM US LLP

A key industry shift that did not slow down in 2022 and will likely continue is the shift from investment in small molecule drugs to biologics and cell and gene therapies. In 2021 and 2022, the FDA approved nearly equal numbers of small molecule drugs and biologics. This represents a long-term trend that is expected to continue based on both the volume of biologics in trials and on the continuing shift of investments away from small molecule drug developers and toward biotechs.

Source: Evaluate Pharma Ltd, RSM US LLP

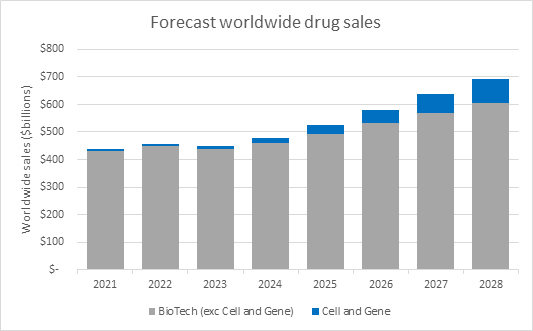

Within this larger trend towards biologic, cell and gene therapies specifically are drawing an outsized level of interest and investment. Based on worldwide sales forecasts from Evaluate Pharma, cell and gene therapy sales are forecast to grow at a faster rate than biologics overall.

The final longer-term trend that will be important to monitor are changes in the regulatory and payer environments. In 2022, the FDA increased scrutiny of accelerated approvals. This has taken two forms. First, the FDA began asking for confirmatory trials to be started and enrolling patients prior to granting an accelerated approval. This requirement increases the timeline and costs of getting a drug on an accelerated pathway onto the market. Additionally, the FDA has increased the scrutiny of the progress and results of those confirmatory trials to ensure that these drugs do eventually meet their primary endpoints.

In addition to FDA scrutiny, the industry should be closely watching the impact of the Inflation Reduction Act and its measures to control drug costs. Although the first impact of these pricing negotiations will not begin to hit specific drugs until 2026, the approach that federal payers take to these negotiations will give the industry an insight into what companies should expect as the number of drugs falling into negotiations increases over time. This is likely to have a substantial impact on biologics over time given the often high costs of these drugs.

The Takeaway

Given the ongoing challenge of raising capital that is expected to persist throughout 2023, this will be a challenging year for biotech executives. They will need to closely manage their cash runway to ensure they are able to continue driving their development pipeline forward while also ensuring they don’t need to raise additional capital until valuations become more favorable. However, for companies that have adequate capital on hand, this is an opportunity to hire talent from other companies and industries that are facing starker challenges. It will also present opportunities to acquire new assets for companies that have substantial cash. However, for that to happen, biotech companies and investors will need to reach agreement on what valuations currently should be.

For 2023’s market outlook for cell and gene therapies, please read my colleague Adam Lohr’s recent Cell&Gene article here.

About The Author:

About The Author:

Steve Kemler is a principal in RSM US LLP’s technology consulting practice and a life sciences senior analyst. His focus on life sciences helps him better understand, forecast, and communicate economic, business, and technology trends affecting middle market businesses. He has experience assisting life sciences clients with technology implementations to help them maximize their investments.