Efficient Biotech Vendor Selection And Management During Economic Uncertainty

By Jennifer Lee, JLC Life Sciences

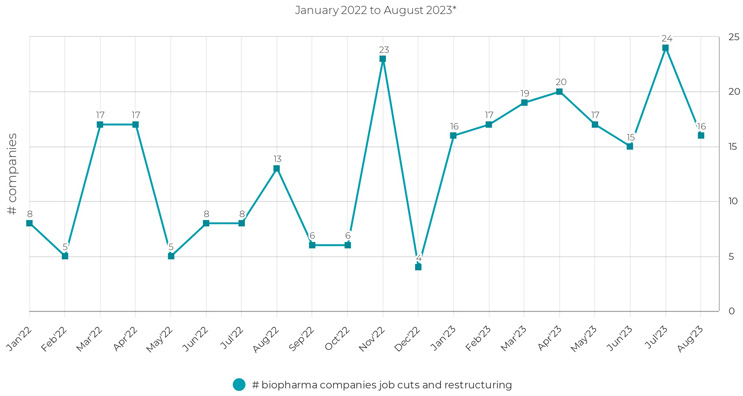

Recent remarks by the chairman of the Federal Reserve serve as a reminder of the current economic challenges, as he remarked that “inflation pressures remain elevated.”1 Although inflation has moderated since last year, the business environment remains fraught with financial obstacles. Data reveals alarming trends in the biopharma industry, with 120 companies implementing layoffs in 20222 and 104 companies doing the same in the first half of 2023. Continuing the preceding trend, the second half of this year began with the announcement of layoffs at approximately 40 biotech companies.3 Amid an unsettling economic backdrop, biotech has resorted to layoffs in response to this funding crunch.

Figure 1: A total of 120 biopharma companies implemented layoffs in 2022, followed by an additional 144 biopharma companies in 2023.3,4 *Data cutoff as of August 18, 2023.

The Current Trend

Increases in cost and economic uncertainty are expected to continue. Studies have shown that amid the uncertainty, the increasing number of clinical trials, the rising outsourcing of research and development activities, and the demand for specialized services are driving the growth of the vendor market. The trend toward personalized medicine, biologics, and biopharma companies seeking out vendors with specific expertise and manufacturing capabilities have also contributed to the CRO/CMO/CDMO market expansion.4,5,6

The current situation is both challenging and intriguing. On the one hand, we have the alarming trend of biotech company layoffs. On the other hand, the market for vendors is expanding. With increasing demand for clinical trials, R&D outsourcing, and specialized services, the landscape of potential vendors is expansive and complex.

The two scenarios may appear illogical, but it exemplifies companies’ dilemma: the pressing need for essential services despite diminishing resources. Therefore, vendor selection extends beyond procurement and becomes a strategic maneuver.

The biotech industry is at a crossroads in this interconnected web of funding restrictions, a growing vendor market, and the complexity of vendor selection.

To navigate these turbulent waters effectively, we must view this funding crunch as a push for creativity and resiliency. This present moment requires a strategy integrating savvy financial management and strategic vendor selection to ensure a thriving biotech landscape despite economic uncertainty.

Savvy Financial Management: Capitalize On Government Grant Programs

For biotech startups, diverse financial assistance sources are a lifeline. Government grants, including specialized agencies, offer considerable monetary support:

- National Cancer Institute (NCI)

- the Defense Advanced Research Projects Agency (DARPA)

- the California Institute for Regenerative Medicine (CIRM)

- Small Business Innovation Research (SBIR)

- Small Business Technology Transfer (STTR) programs at the National Institutes of Health (NIH)

- Biomedical Advanced Research and Development Authority (BARDA)

- Small Business Research grants from the National Science Foundation (NSF)

- FDA Orphan Products and Development

Augmenting this funding source with efficient vendor management practices ensures the highest possible return on investment and judicious use of resources in the economic uncertainties.

3 Considerations For Vendor Selection In A Constrained Budgetary Climate

1. Price Versus Value Dilemma

While cost remains a primary consideration in a vendor selection, a singular focus on the price tag can have negative effects on R&D quality.

This pitfall is exemplified by an IRT vendor that attracted a midsize biotech customer in recent year with competitive pricing for a basic template. But with a few customizations, the vendor increased the service prices by a staggering 48%.

Therefore, it is essential to conduct a thorough evaluation that considers the vendor’s experience, culture, capabilities, service quality, delivery timelines, and financial stability.7 Selecting a vendor should involve a comprehensive evaluation that goes beyond just cost to ensure quality and reliability in service.

2. Is the Vendor — and Are You — Effectively Using Technology?

A delicate dance between tradition and innovation is essential in vendor relations and management. Emerging vendors can offer innovative solutions that can transform operational efficiency; take, for instance, an AI company that compares CRO proposals.8 Conversely, established relationships may offer familiarity, trust, cost savings, and favorable terms. Regular reevaluation of suppliers and investigation of cutting-edge solutions ensures competitiveness and innovation infusion. In the interest of operational efficiency, businesses must identify technological means to reduce labor-intensive tasks and increase productivity. Nevertheless, it is crucial to evaluate the practicability and cost-benefit ratio of such technological implementations. Initial expenditures, training expenses, and potential long-term gains merit consideration.

3. Vendor Evaluation and Ongoing Performance Monitoring

A rigorous and consistent evaluation, based on the track record, deliverables, and dedication of vendors, can ensure value without sacrificing quality. Repetitive requests for revisions due to insufficient quality assessment, poor communication, or a lack of proactive risk management strategies are red flags in vendor relations.

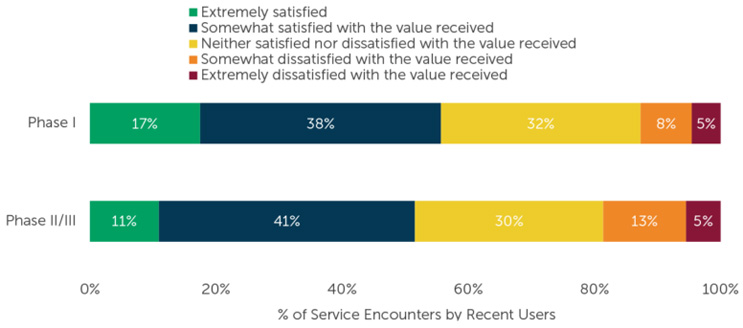

A recent ISR survey diving into biotech companies paint a mixed picture of vendor satisfaction. It revealed that approximately half of the recently availed vendor services met somewhat of expectation. In contrast, less than 20% of Phase 1 and Phase 2/3 service interactions were rated as somewhat or extremely unsatisfactory and one-third of respondents were neither satisfied nor dissatisfied with the value received.9

Complementing this data, a comprehensive survey involving 80 CRO clients — spanning from large and small pharma and biotech — indicated a palpable sentiment: they feel underserved by CROs.10

Figure 2: Sample size varies by number of users, per CRO. “Please indicate how satisfied you are with the value of the services you received from each of the below providers. Please think of ‘value’ as the services you received as compared to the cost for those services.” Figure used with permission from ISR.

To address these issues, the establishment of a robust vendor performance oversight system is paramount. Such a mechanism, designed to monitor and analyze performance metrics, can provide invaluable insight into vendor efficiency, responsiveness, and capability to identify potential issues early on.

Vendor performance monitoring systems include:

- Data surveillance for identifying trends, outliers, patterns, anomaly detection, forecasting, signal detection, threshold alarms, real-time monitoring, and association analysis

- Key performance indicators (KPIs) to measure metrics, for example, on-time delivery rate, error rate, response time to queries, and % data reviewed

- Quality audits to ensure adherence to applicable standards

- Service level agreements to assess variance between expected and received levels of service

- Stakeholder feedback to assess and gain insights into vendor performance

- Risk management to evaluate risks (such as supply chain disruptions, geopolitical risks, rising inflation, new work expectations, new modalities capital expenditure, and labor market challenges)

- Product quality checks of the products or materials by random sampling to determine the vendor’s compliance with quality standards

- Regular reviews and meetings with stakeholders to assist in addressing issues, assessing performance, and preparing for contingencies

The current funding squeeze represents a unique opportunity for the biotech industry. By adopting a balanced strategy that integrates smart vendor selection, forward-leaning technological investments, and the strategic application of grant opportunities, the industry can navigate moving economic currents and thrive despite a biotech funding shortage.

References

- Powell Tells Congress to Expect Interest Rates to Rise Again - The New York Times (nytimes.com)

- Layoff Tracker: 2022

- Layoff Tracker: 2H 2023

- McKinsey Report: CROs and biotech companies: Fine-tuning the partnership

- Globe News Wire Report: Biopharmaceutical CMO and CRO Market Size to Reach US$ 59.4B

- Pharmaceutical CDMO Market Size, Share & Trends Analysis Report By Product (API, Drug Product), By Workflow (Clinical, Commercial), By Application (Oncology), By Region, And Segment Forecasts, 2023 - 2030 (researchandmarkets.com)

- You Said You Want A Collaborative Vendor. Here is How to Build One. | LinkedIn

- Save Time And Money By Using AI To Compare CRO Proposals (clinicalleader.com)

- Can't Stop Us Now: CRO Growth Amid Uncertainty (isrreports.com)

- McKinsey Report: CROs and biotech companies: Fine-tuning the partnership

About The Author:

Jennifer Lee is the CEO and founder of JLC Advisory, LLC, a life sciences consulting firm. She has held positions in small, mid-sized, and large pharma/biotech companies and is an expert in advancing drug development pipelines from preclinical to commercialization. She has overseen the development of product candidates in oncology, CNS, infectious/rare disease, and immuno-gene/cell therapies. She contributed to the global approval of seven novel therapies and has also contributed to licensing agreements, successful exits, and improved labels. Lee graduated from the University of Illinois at Chicago with a bachelor's degree in biochemistry and from Northwestern University with a master's degree in clinical research and regulatory administration.

Jennifer Lee is the CEO and founder of JLC Advisory, LLC, a life sciences consulting firm. She has held positions in small, mid-sized, and large pharma/biotech companies and is an expert in advancing drug development pipelines from preclinical to commercialization. She has overseen the development of product candidates in oncology, CNS, infectious/rare disease, and immuno-gene/cell therapies. She contributed to the global approval of seven novel therapies and has also contributed to licensing agreements, successful exits, and improved labels. Lee graduated from the University of Illinois at Chicago with a bachelor's degree in biochemistry and from Northwestern University with a master's degree in clinical research and regulatory administration.