Innovators' Next-Gen Strategy: Is Obsolescence The Best Biosimilar Defense?

By Tucker Herbert, ZS Associates

As biosimilars are targeting drugs with more than $5 billion in annual revenue, the originator manufacturers desperately need to find ways to either defend or replace that revenue. Strategies have included portfolio contracting, rebating, patent pursuits, supply chain differentiation, licensing deals, and building customer loyalty. Many biosimilar targets are developing next-gen products as a life cycle management or defense strategy in advance of loss of exclusivity (LOE). To do so, they try to make their own product obsolete by the time that competition arrives by developing a superior next-generation product, formulation, or delivery device to provide an incremental benefit to patients in the disease area facing impending biosimilar competition. When a biosimilar developer is faced with this scenario, it provides both challenges and opportunities for its uptake in the market.

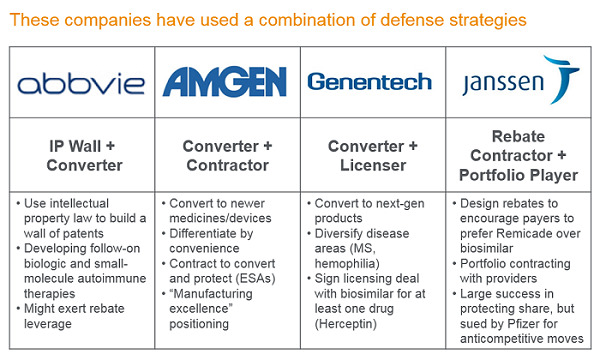

Many manufacturers on the precipice of biosimilar competition (GNE, AbbVie, Amgen, Janssen, etc.) have used the next-gen product strategy as part of their biosimilar defense. A next-gen product can involve a new formulation that allows improved mode of administration (like Rituxan Hycela), long-acting version (such as Epogen to Aranesp), a new agent for a combotherapy (such as Herceptin + Perjeta), a “biobetter” within the same drug class (such as Gazyva or Kadcyla), or pursuit of a new class of drug in the same disease area (such as Risankizumab, Simponi, Stelara, or Evenity).

When a biosimilar developer is faced with this scenario, there are both challenges and opportunities for its uptake in the market. Apart from helping them to smooth out the loss in revenue, they often have a competitive advantage in the therapy area. (The idea being to cannibalize yourself before someone else does.) The advantage can be due to physician relationships (including sales reps and reputation in a therapy area); institutional therapy area knowledge; leveraging patient support programs; and adjusting the promotion/discounting strategy of the first-gen product to support conversion.

The timing is critical. Ideally, companies will launch at least one to three years prior to LOE, which allows the first-gen product to be used as an anchor point for pricing (rather than the biosimilars). Moreover, the companies can adjust the price of the first-gen product to encourage conversion. Post-LOE, if biosimilars are 35 percent cheaper than the first-gen product, the next-gen product hoping for a 10 percent price premium would appear nearly 50 percent more expensive than the alternative. Even if a next-gen product launches post-LOE, while not ideal, it can still have a runway to drive uptake as the biosimilars are not initially expected to present as large of a price differential when compared to the price differential that would exist vs. a generic. This makes it easier to justify the incremental cost for the additional benefit, so payors may then choose to fight other battles.

How Is This Different From Small Molecule Defense?

In some ways, this is a strategy that has also been used by manufacturers of small molecules, so how is it different now for biosimilars? Part of it is in the scale of cost savings. For example, if a small molecule next-gen product is 20 percent better, but a generic drug launches at 10 percent of the cost, it can be difficult to drive conversion, whereas if a biologic next-gen product is 20 percent better and a biosimilar launches at 30 percent lower cost than the originator, then the biosimilar can appear a better value for the associated efficacy/tolerability improvement.

Additionally, as many biosimilar defenders are medical benefit drugs, it may be more difficult for them to rapidly drive conversion to a next-gen product; with small molecules, a manufacturer could negotiate with payors to secure preferred placement and encourage physicians to rapidly adopt the next-gen product – slower conversion would mean that more of their originator portfolio volume will be exposed.

Impact On Biosimilar Developers

While biosimilar manufacturers might feel discouraged, the reality is that this is could be to their advantage, as next-gen products could help biosimilar market share in several ways. Originators aim to convert use to new molecular entities (NMEs), which have improved efficacy, safety, or ease of administration. Driving conversion may also require the manufacturer to reduce promotion on its earlier-generation product. Additionally, the originator would face disincentives to compete aggressively with biosimilars on price, as this would cannibalize or slow conversion to its next-gen product.

Here are some key considerations that a biosimilar developer should ask when targeting a reference product that may see an NME from the same developer:

- Will the NME launch before the original product’s LOE? How much overlap will the biosimilar developer have before the first LOE? Will they have at least a runway of two to three years to reach peak sales?

- How differentiated is the NME? Superior efficacy? Better safety? More convenient dosing/administration?

- Will the NME be approved for all indications as the original product?

- What proportion of the manufacturer’s portfolio does the original product account for?

- How will the NME be priced when compared to the original product? What are the implications? How will the manufacturer respond?

- Do the NME and original product belong to the same manufacturer? If so, will the manufacturer aggressively drive conversion of patients on the original product to the NME?

Key Considerations For Biosimilar Defenders

Similarly, biosimilar defenders need to make difficult choices about where to spend their time, energy, and resources. Some of these tradeoffs include:

- When they first launch their next-gen product, should they “price to convert” or “price to value”?

- How should they structure any portfolio contracts to both drive conversion and defend against biosimilars? Should they pursue one-year contracts with modest discounts or longer contracts with steeper discounts?

- If they have converted 30 percent to the next-gen product by the time the biosimilar launches, should they devote their efforts to continue to drive conversion while leaving the other 70 percent fully exposed?

- How aggressively should they incentivize sales reps to drive conversion and message that the original product is now obsolete?

Internally, company politics may interfere with the optimal strategy for the firm when different brand managers and teams support their original and next-gen products. Externally, a more assertive conversion strategy can preserve long-term revenue, but may create near-term challenges to meet Wall Street expectations.

Risks To Next-Gen Strategy

Because the largest targets of biosimilars are “blockbuster” drugs, and achieving blockbuster status typically requires a product to offer breakthrough efficacy, this sets a high bar for the manufacturer to overcome if it aims to make that product obsolete. As a result, this poses a risk that the next-gen product may not show a statistically significant improvement vs. the earlier product (Avastin, for example). To mitigate this risk, no biologic manufacturer appears to have pursued this as its sole defense tactic.

Also, pursuing an incremental improvement could present a distraction from pursuing a truly innovative breakthrough therapy as it still requires significant R&D and executive leadership bandwidth to develop a next-gen product. A trivial improvement could harm a firm’s perception among physicians as they could view the improvements as underwhelming and, therefore, doubt the firm’s commitment to driving scientific progress.

Conclusion

So, should every manufacturer facing biosimilar competition pursue a next-gen strategy? While some may trivialize the value of an incremental improvement, even if a modification can “just” improve average patient adherence by 10 percent, that can translate to a meaningful improvement in outcomes for millions of patients’ lives. So, is it ethical? Given the potential for a meaningful impact, developing a product that makes the original product obsolete may in fact be the most ethical form of biosimilar defense.

About The Author:

Tucker Herbert is a strategy insights and planning manager for ZS Associates, based in the company’s Los Angeles office. He has advised major biotechnology firms on a broad range of sales and marketing strategy issues, with an emphasis on oncology and biosimilars. His experience has focused on global quantitative and qualitative primary market research and secondary data analytics. Herbert was one of the founding members of ZS’s Biosimilars Vertical, and he has led over 30 training sessions across in North America and Asia on the topic. Herbert holds an M.B.A. from UCLA and a B.A. from Stanford.

Tucker Herbert is a strategy insights and planning manager for ZS Associates, based in the company’s Los Angeles office. He has advised major biotechnology firms on a broad range of sales and marketing strategy issues, with an emphasis on oncology and biosimilars. His experience has focused on global quantitative and qualitative primary market research and secondary data analytics. Herbert was one of the founding members of ZS’s Biosimilars Vertical, and he has led over 30 training sessions across in North America and Asia on the topic. Herbert holds an M.B.A. from UCLA and a B.A. from Stanford.