Strategies For Commercial Success In The Global Biosimilar Market

An article recently published on Biosimilar Development identified and described six company archetypes that currently make up the biosimilar market: opportunists, bio powerhouses, biosimilar machines, generic giants, bio wizzes, and genericists. We liked this concept so much that we reached out to biosimilar experts from several prominent management consulting firms to ask for their perspectives on these archetypes, emerging biosimilar development and business strategies (as well as mistakes to avoid), and the market’s future. In part 1 of this series, we heard from Mark W. Ginestro, principal in KPMG's Healthcare and Life Sciences strategy team. In this installment, McKinsey & Company’s Daniel Swann (junior partner), Jorge Santos da Silva (partner), and Jennifer Heller (consultant) share their insights.

Based on your understandings of current market players, which of the biosimilar archetypes do you expect to be most successful in the market, and why?

Jennifer Heller: The six outlined archetypes, which categorize biosimilar companies largely by their development approach, will likely have varying success depending on the product categories in which they focus.

Jennifer Heller: The six outlined archetypes, which categorize biosimilar companies largely by their development approach, will likely have varying success depending on the product categories in which they focus.

For example, opportunist and bio powerhouse players, which may have sophisticated biologics R&D engines but are less experienced in low-cost development programs, will likely be better positioned to find success in developing biosimilars that complement their existing portfolios. By strategically identifying potential biosimilar targets based on fit with their overall business, companies with these archetypes will have the advantage of drawing on existing commercial infrastructures to differentiate themselves from other biosimilar players and to capture potential cost synergies, such as a medical team with existing relationships with healthcare practitioners (HCPs), joint sales force, and patient support programs.

Companies characterized as biosimilar machines, however, have the advantage of a focused biosimilar pipeline, with the opportunity to apply continuous learnings to create a rigorous and streamlined development and launch program. This experience could enable efficiencies that significantly reduce biosimilar development costs and timelines — that is, through investments in advancing analytical methodologies, thereby reducing requirements for clinical studies and streamlining regulatory processes. Biosimilar manufacturers with this archetype would thus be well positioned to launch multiple products in rapid succession and to potentially capture additional share through their early position in the market.

The success of the other archetypes — generic giant, bio wiz, and genericist — will largely depend on the partners they select, either in the development or commercialization process. Identifying the right commercial partners, in particular, will be key to their success, as the commercial model (or models) chosen is critical to realizing the value of biosimilars.

Do you see other archetypes emerging into the market, today or in the future?

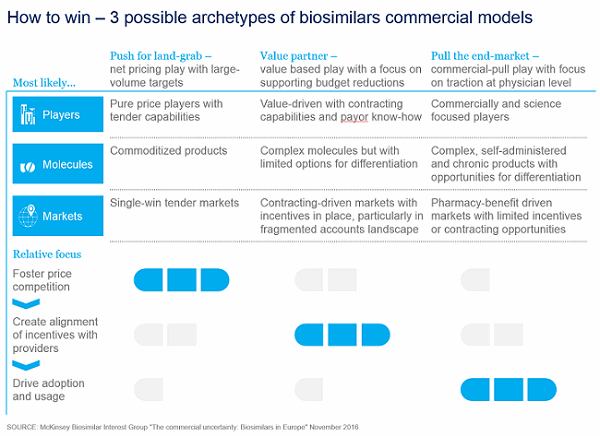

Daniel Swann: When looking at the range of archetypes emerging in the market today, we also identified some commercial model archetypes for biosimilar manufacturers, which outline how players will approach bringing their products to market. In the continually evolving biosimilar landscape, three important elements will influence the commercial models chosen by biosimilar players:

Daniel Swann: When looking at the range of archetypes emerging in the market today, we also identified some commercial model archetypes for biosimilar manufacturers, which outline how players will approach bringing their products to market. In the continually evolving biosimilar landscape, three important elements will influence the commercial models chosen by biosimilar players:

- The room to play given the likely limited profitability corridor available

- The role of non-price-related factors in affecting the level of pull required for certain molecule types (such as for chronic therapies)

- Differences in competing against originators versus other biosimilar players

We see three possible emerging archetypes for the commercial model, with multiple variations and permutations possible based on individual circumstances (see Figure 1).

1. Push for landgrab — net pricing play with large volume targets

This is the archetype most likely to be favored by players unwilling to set up a large commercial footprint, and which need to keep marketing and sales expenditure low and focus on large single-win tendered accounts to drive volumes at the expense of prices. It builds on a willingness to drive large volumes rapidly (all the way to the full market) in exchange for significant price drops (up to approximately 70 percent).

This model applies well to molecules that have low barriers to adoption. This includes simpler or commoditized molecules such as granulocyte-colony stimulating factor (G-CSF) or erythropoietin (EPO) and rapid turnover of the patient population, either because of the short duration of treatment — as in oncology — or because of the push to switch, leading to relatively rapid switch-outs (as in the Nordic countries with the infliximab biosimilar tenders).

Success with this “push-push-push” business model, particularly where multiple competitors are present, requires a strong focus on tender capabilities and operations (for example, careful mapping of tender windows, strong knowledge of tender criteria, the ability to adapt supply chain to meet tender needs, and a centralized view of tender outcomes to adjust pricing behavior).

2. Value partner — value-based play with a focus on supporting budget reductions

While pricing is expected to remain broadly the key concern for payors, it will not be the only concern. For a number of payors in particular — especially in the EU-5 and southern Europe generally — one critical issue will likely be how they manage their overall budgets and drive total savings, especially in the early days of biosimilar adoption. Indeed, for many payors, a drop in net price alone does not necessarily mean an immediate budget impact. Three major interlinked factors can affect the way in which price is translated into savings: the speed of uptake of biosimilars (and thus the speed at which accounts prescribe), the amount of discount offered by the originator, and any associated non-drug-related costs.

Given the originators’ control of the entirety of volumes when the biosimilars are launched, even offering a small discount on the branded product can have a significant impact on a payor’s budget. As such, payors might be worried that, if biosimilars penetrate the market too slowly, they will lose out on important savings (even more so if they no longer have a contract with the originator). In such cases, it is up to the biosimilar players to offer payors the right combination of an attractive pricing structure, a demonstrated ability to generate rapid uptake, and an overall budget impact—that is, both some “push” and some “pull.” Players with more advanced and differentiated commercial and medical approaches to aligning stakeholders will likely gain an important edge in “pulling” volume.

Get an inside look at changing regulations, approvals, uncertainties, and opportunities to shed light on how your biopharmaceutical business should best adapt its approach in this webinar:

Biosimilars: Preparing For Opportunities And Challenges

3. Pull the end market — commercial pull model with a focus on traction at physician level

Finally, some products, geographies, or accounts might require a somewhat “traditional” commercial effort. This is likely to be true both in markets where very limited incentives are in place (for example, in the French retail setting) and for products whose intrinsic features make the brand particularly important. Examples include particularly strong device differentiation (as with certain autoimmune diseases or in the case of multiple sclerosis, where device loyalty can run high given long-term use, potential injection-site reaction, and associated injection pain) or the role of a strong patient-support program in creating loyalty among patients and physicians.

Biosimilar players with a particular “edge” or product differentiation might be best placed to benefit from such a commercial model. However, this is likely to work above all in situations where the characteristics of the molecule — for example, those that are highly complex with higher cost of goods sold (COGS) or those requiring significant patient support programs — might lead to higher prices. In such situations, there might be more P&L flexibility to set up such a model — or in situations where the biosimilar player is able to pinpoint where to invest with the greatest return on investment (ROI) per channel and develop strong offerings (for instance, through digital and remote engagement without the need for headcount-heavy platforms).

Figure 1: Three possible archetypes for biosimilar commercial models are emerging.

What biosimilar business strategies have you noted as being particularly effective in the U.S. and EU markets?

Swann: The most successful approaches have been the ones that have adapted the commercialization approach to market and molecule specificities.

For instance, the type of capabilities, organization sizing, and activities that need to be undertaken in a single-win tender market like Denmark, where all incentives are geared toward biosimilar adoption, will differ significantly to what is required to sell a product in the retail market in France, where very few if any incentives are in place.

In general, we observe that three factors drive successful adoption of biosimilars: successful price competition, alignment of incentives across market stakeholders, and the pull of the end-market. The importance of each of these varies significantly across markets. For instance, in Norway or Denmark, the more successful companies tend to be those that focus on competing successfully on price in large tenders that unlock a majority of the market; beyond that, limited pull is required as the systems take care of adoption. Conversely, in markets such as the United Kingdom where clinical commissioning groups (CCGs) and trusts are increasingly contracting on a “gainshare” basis (sharing savings of biosimilars if certain penetration thresholds are met), price alone is not enough and actively supporting the product uptake for providers to hit their targets is often critical.

The weighting between different commercial focus areas can also vary within one market depending on the molecule. Indeed, channels and thus stakeholders and incentives differ. For instance, French hospitals are highly incentivized to tender hospital products such as infliximab and to generate savings. In contrast, for retail-delivered products — such as growth hormone today or most of the self-injectable autoimmune biosimilars coming soon to market — no real incentives are in place to push prescription of biosimilars, so some level of commercial activity with the end-customers (physicians) will most likely be required.

Have you noted any particularly effective strategies companies are employing in emerging markets — either in development or commercialization?

Jorge Santos da Silva: In emerging markets there are a few models that have arisen in the past eight to 10 years, all of which have been successful in their own ways. You have several players developing and producing first-gen products (such as recombinant human erythropoietin, or EPO), for instance in China or India. These products are comparatively simple to produce, and they are commercialized locally or in neighboring countries with similar regulatory approaches for approval. In the case of China, these products predate the recent biosimilar regulatory framework.

Jorge Santos da Silva: In emerging markets there are a few models that have arisen in the past eight to 10 years, all of which have been successful in their own ways. You have several players developing and producing first-gen products (such as recombinant human erythropoietin, or EPO), for instance in China or India. These products are comparatively simple to produce, and they are commercialized locally or in neighboring countries with similar regulatory approaches for approval. In the case of China, these products predate the recent biosimilar regulatory framework.

In some cases, locals companies have moved to more complex molecules — including monoclonal antibodies (mAbs) — with some apparent success and without any widely reported issues in market. This includes secondary local brands for originator products as in India for Roche products.

You also have an emerging model based on tech partnerships, as observed in Brazil. In this case, the development is carried out by a nonlocal company (typically a multinational corporation), and the tech is transferred to local players, which share responsibility for commercialization and, in principle, will over time also become responsible for manufacturing upon conclusion of tech transfers into local sites. These partnerships are mostly focused on mAbs.

The final model is a more traditional partnership model where a developer (such as Celltrion) licenses product for local commercialization by a local leader. This can be observed in some Middle Eastern countries, for example.

What are the biggest mistakes you see biosimilar companies making today? What concerns do these mistakes raise for you in terms of surviving in specific markets?

Heller: As we are relatively “early” in the market, and few players are actively competing across molecule types, it is hard to pinpoint specific mistakes; however, there are a number of elements that biosimilar playersshould consider as they think about their commercialization approach. Two major ones that we see are:

- Underestimating the barriers to entry that have been set up and fostered by originator players, notably in terms of incentive structures for the main market stakeholders. For example, most originators have strong channel presence at provider level for medical benefit products in the United States.

- Limited agility and financial planning flexibility is another. What we have observed in the market so far are deeper price discounts than expected across the board, highly heterogeneous uptake across markets (for instance, over 90 percent penetration in Denmark and over 20 percent in France for infliximab), and multiple changes in the competitive landscape (for example, delays in approvals, portfolio acquisitions, and dropouts). As such, original forecasts, investment plans, and ROI targets are up in the air for many players. Being able to react quickly, adjust planning and resourcing, modify expectations, and communicate these to the markets will be critical in the medium term for biosimilar companies to be truly successful.

Flash forward 10 years down the road. Companies will need to be creative to differentiate their biosimilars from the others on the market. Besides price, what specific incentives will companies need to offer to stand out?

Swann: For us, the biggest question 10 years down the road would be how sustainable the industry as a whole will be. Indeed, with faster price declines than expected and the likelihood of very intense competition — and simultaneous entry of large molecules driving the business cases (for example, adalimumab) — a few of the actors in play today might not be willing to sustain the financial risk (and potential dilution in profitability). Moreover, the next wave of biosimilar products is likely to be more scattered in terms of opportunity: While most of the products in wave 2 are over $5 billion in value (for example, adalimumab, etanercept, bevacizumab, and trastuzumab), the products in wave 3 will be smaller and closer to the $800 million to $2 billion range. As such, making these products successful will require tighter business cases across the board.

Therefore, we expect the long-term winners to be the players that are able to reduce their overall development costs significantly and optimize analytics, patient recruitment, and time to market in order to keep having sustainable business cases in an evergreen way. Overall sustainability of the industry will also depend heavily on the regulatory framework, which may or may not offer more streamlined development for biosimilars.

In part 3 of this three-part series, experts from L.E.K. Consulting share their perspectives on these questions.