Subcutaneous Infliximab In The U.S.: Assessing CT-P13 SC's Impact Across Indications

By Rose Joachim, Ph.D., senior healthcare analyst, GlobalData Plc

This is the second article in a two-part series exploring the anticipated competitive dynamics for Celltrion’s subcutaneous  (SC) infliximab bio-better, CT-P13 SC, in the U.S. Part 1 highlighted the unique strengths of CT-P13 SC compared to intravenous (IV) infliximab, including its ability to provide patients with more freedom of choice and cost savings. In Part 2, we explore how the market dynamics across different autoimmune indications will drive distinct uptake of CT-P13 SC, highlighting the potential impact on competition within the TNF inhibitor class.

(SC) infliximab bio-better, CT-P13 SC, in the U.S. Part 1 highlighted the unique strengths of CT-P13 SC compared to intravenous (IV) infliximab, including its ability to provide patients with more freedom of choice and cost savings. In Part 2, we explore how the market dynamics across different autoimmune indications will drive distinct uptake of CT-P13 SC, highlighting the potential impact on competition within the TNF inhibitor class.

Variable Potential Across Different Autoimmune Indications

One of the most crucial factors driving CT-P13 SC market dynamics in the U.S. will be the number of indications it is approved for in 2022. Ongoing pivotal trials in the U.S. are testing CT-P13 SC in ulcerative colitis (UC) and Crohn’s disease (CD). Thus, unless the FDA chooses to set new precedents for bio-betters and extrapolate approval to additional diseases, UC and CD will be the only two approved indications when CT-P13 SC is launched in 2022.

In this scenario, the question is whether Celltrion will pursue development of CT-P13 SC in additional diseases and if so, which would have the greatest potential impact on sales. Important considerations include the overall size of the infliximab market for each indication, the number and variety of drugs currently approved, and the importance of IV infliximab in the line-up of available treatments. While the first factor provides insight into the competitive space for infliximab products, the other two factors define the potential for CT-P13 SC to compete within the entire TNF inhibitor class. In particular, the ability to compete with adalimumab biosimilars, launching in Q1 2023, will define the growth trajectory for CT-P13 SC.

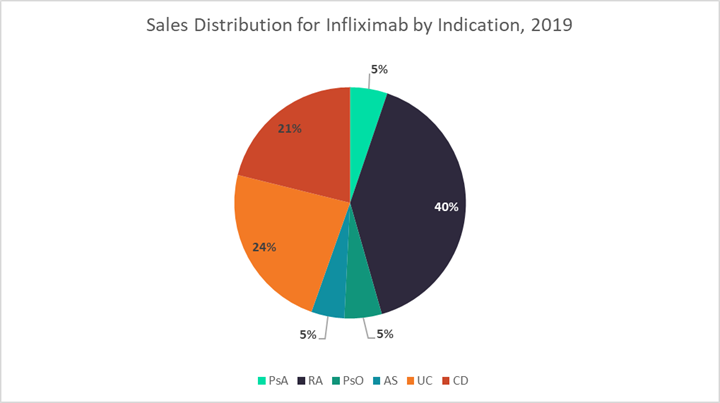

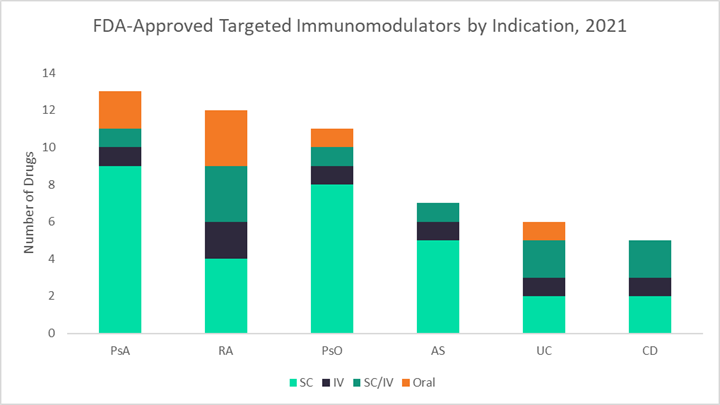

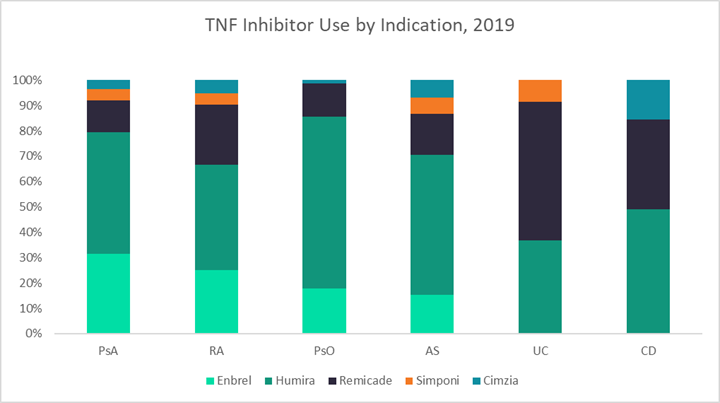

The figures below use data from GlobalData’s latest market research reports on six autoimmune diseases — UC, CD, rheumatoid arthritis (RA), psoriasis (PsO), psoriatic arthritis (PsA), and ankylosing spondylitis (AS) — to highlight key differences in both general and infliximab-specific market dynamics across these indications.1–6 The first graph shows the 2019 sales distribution for infliximab across all six indications, the second displays the number of targeted immunomodulators currently approved for each indication, and the third breaks down the percentages of patients receiving different TNF inhibitors in 2019.

Generally, GlobalData expects that indications with stronger historical infliximab sales, like UC, CD, and RA, will be the most lucrative markets for CT-P13 SC, as the pool of patients receiving IV infliximab who may want to switch to an SC formulation is already quite large. Additionally, in indications with fewer treatment options overall, like UC and CD, there is a higher probability that CT-P13 SC will be used to treat new patients or patients switching to a new therapy due to loss of efficacy. Finally, GlobalData expects that CT-P13 SC will be the most resilient to adalimumab biosimilar competition in indications that use the most infliximab — so once again, UC, CD, and RA. However, potential pricing differences between CT-P13 SC and adalimumab biosimilars will play the biggest role in defining market dynamics.

In the following sections, we evaluate these factors in more detail and use them to define the potential for CT-P13 SC across different indications in the autoimmune disease space.

UC And CD Are Crucial Markets

UC and CD are clearly two of the most important indications for CT-P13 SC, which is likely why they are the focus of Celltrion’s U.S. clinical trial program. GlobalData estimates that in 2019, infliximab accounted for 55% and 35% of TNF inhibitor use by volume in UC and CD, respectively. Together this represented 45% ($1.6 billion) of total infliximab sales among adult patients. Infliximab is the gold standard TNF inhibitor for the treatment of inflammatory bowel disease (IBD), both because of its long history of use as well as its strong track record of efficacy in some of the toughest-to-treat patients. For example, it is the only biologic formally approved to treat fulminant disease in UC and perianal fistulas in CD.

However, despite somewhat lower efficacy, Humira is still very frequently used in the treatment of IBD. Based on GlobalData’s market research in the U.S., 37% of patients with UC and 49% of patients with CD were treated with Humira in 2019. It is possible that this treatment pattern is due to the drug’s SC formulation, which allows for more convenient maintenance dosing. If so, the launch of CT-P13 SC could lead to an additional increase in infliximab usage over Humira. Infliximab’s strong efficacy profile in IBD may also help curb competition from adalimumab biosimilars, even if costs end up being comparable.

Compared to other autoimmune indications, UC and CD have the fewest number of approved targeted immunomodulators overall — about half those available for PsA, RA, and PsO. Thus, introducing a new SC formulation for one of IBD’s most important drugs is likely to have a lasting impact. GlobalData believes that although CT-P13 SC may not encourage a great deal of TNF inhibitor switching among patients on stable maintenance therapy (except of course those receiving IV infliximab), it will likely see robust uptake among new starts and patients seeking to improve disease control with a new therapy.

RA Is A Strategically Sound Next Step

After UC and CD, GlobalData believes RA will be Celltrion’s next target market for CT-P13 SC in the U.S. The size of the IV infliximab market for RA is only slightly smaller than for IBD, comprising about 40% of U.S. infliximab sales ($1.5 billion) in 2019. Although RA is a densely competitive market with 12 targeted biologic and small molecule drugs currently available, infliximab remains a key player with frequent usage in the earliest lines of therapy. According to GlobalData’s market research, infliximab accounted for about 25% of TNF inhibitor use for RA in 2019. While Humira and Enbrel are important competitors, together representing about two-thirds of TNF inhibitor usage for RA, the annual cost of these branded agents is anticipated to be more than twice that for CT-P13 SC. This may give Celltrion the opportunity to claim new additional patient share for its infliximab product, particularly among patients looking to initiate a new therapy.

The future of CT-P13 SC in RA becomes cloudier with the imminent launch of adalimumab biosimilars in 2023. Compared with IBD, in RA adalimumab is considered equivalent to infliximab in its clinical utility. Without head-to-head data demonstrating clinical superiority of CT-P13 SC over adalimumab, pricing will be the main differentiating factor between these products. In the U.S., the annual cost of Humira maintenance therapy (based on wholesale acquisition cost pricing) is around 2.3 times that for Remicade (based on 5 mg/kg dosing every eight weeks). Assuming CT-P13 SC is discounted by at least 17% off branded Remicade, adalimumab biosimilar producers would need to discount their products 62% off the cost of Humira in order to match it. While huge price cuts like these were seen for adalimumab biosimilars in Europe, it is unclear whether biosimilar producers will be as bold in the U.S. GlobalData believes that Celltrion should use the earlier timing of CT-P13 SC’s launch as an opportunity to shock the TNF inhibitor market with a deep price cut. This could enable the product to claim new patient share from more expensive TNF inhibitors. If the discounts are deep enough, it may even take adalimumab biosimilars a while to catch up.

Other Infliximab Indications Are Less Promising

The indications in which CT-P13 SC will likely have the smallest impact are PsA, PsO, and AS. In 2019, infliximab accounted for 12 to 16% of TNF inhibitor use across these indications, representing only 15% of U.S. infliximab sales overall. Instead, patients with PsA, PsO, and AS are treated heavily with Humira: 48%, 68%, and 55% of patients receiving a TNF in each indication, respectively. Although dependent on pricing dynamics, with such low usage of infliximab compared to adalimumab in these indications, it is likely that the launch of adalimumab biosimilars in 2023 will eclipse the ability of CT-P13 SC to claim patient share from other non-infliximab TNF inhibitors. Another factor that may further slow the uptake of CT-P13 SC in PsA and PsO is the large number of targeted agents currently available for treatment — 13 and 11, in each respective indication. However, AS does not have as long a list of drugs approved to treat the disease (seven biologics as of March 2021), which could lead to a higher potential uptake of CT-P13 SC in AS compared to PsA and PsO.

Other Factors To Consider

There are numerous other factors that may define the competitive potential of CT-P13 SC in the U.S. First, Celltrion must set itself up to exist within the complex contracting and rebate system that defines the U.S. payer landscape. It is unknown if Celltrion will collaborate with Pfizer in marketing CT-P13 SC in the U.S., as it has done for its IV infliximab biosimilar, Inflectra. This would likely be a good move, as Pfizer already has a stake in the autoimmune disease market with its Janus kinase inhibitor, Xeljanz. This could potentially be leveraged to improve formulary placement for CT-P13 SC.

Second, there are ways that Celltrion could further expand the market size of CT-P13 SC. As discussed in the sections above, aggressive discounting will be crucial if the company hopes to claim significant patient share outside of IBD. Another small but important area in which Celltrion could seek to carve out new patient share is in the treatment of pediatric populations. J&J’s Remicade is currently approved for the treatment of children with CD or UC; if Celltrion pursued the approval of CT-P13 SC in younger patients, this could provide a new option for patients with very few choices. As a SC therapy, CT-P13 SC could provide relief to caregivers and children struggling to fit monthly or bi-monthly infusions into their busy lives. It may also help to minimize disease-related trauma in younger patients by allowing a trusted caregiver to administer therapy at home.

Conclusions

GlobalData believes that Celltrion’s CT-P13 SC will likely see better uptake patterns in the U.S. compared to IV infliximab biosimilars. The SC formulation will provide patients with greater freedom and will cut down on infusion costs. Furthermore, based on trends in Europe, Celltrion appears willing to make the drug very cost competitive. If Celltrion brings this same strategy to the U.S., CT-P13 SC will be a strong contender among both branded and biosimilar infliximab products. Low enough prices may even allow CT-P13 SC to claim new market share within the overall TNF inhibitor class, mainly due to new starts and patients moving to new lines of therapy. CT-P13 SC uptake will be strongest among patients with IBD, as infliximab is the gold standard TNF inhibitor in the treatment of UC and CD and fewer disease-modifying therapies are currently available. Strategically, RA is the next indication with the greatest potential for CT-P13 SC uptake, followed by AS, PsO, and PsA. By combining the strong efficacy of infliximab with convenient SC delivery at a lower cost, Celltrion’s CT-P13 SC is poised to make a lasting impact on the U.S. autoimmune disease market.

About The Author:

Rose Joachim, Ph.D., is a senior healthcare and pharmaceutical analyst at GlobalData. As an analyst, she has authored numerous reports and articles analyzing market dynamics within the autoimmune, allergic, and hematological disease spaces. In 2017, Joachim earned her Ph.D. in biological sciences in public health at Harvard University. Her dissertation research explored the effects of age on immune system function during sepsis. When she wasn’t at the bench, she spent her time teaching and developing new science curricula as part of the Science Education and Academic Leadership certificate program at Harvard. Prior to her graduate studies, Joachim earned her B.S. in biology with a minor in chemistry from The College of New Jersey.

Rose Joachim, Ph.D., is a senior healthcare and pharmaceutical analyst at GlobalData. As an analyst, she has authored numerous reports and articles analyzing market dynamics within the autoimmune, allergic, and hematological disease spaces. In 2017, Joachim earned her Ph.D. in biological sciences in public health at Harvard University. Her dissertation research explored the effects of age on immune system function during sepsis. When she wasn’t at the bench, she spent her time teaching and developing new science curricula as part of the Science Education and Academic Leadership certificate program at Harvard. Prior to her graduate studies, Joachim earned her B.S. in biology with a minor in chemistry from The College of New Jersey.