Subcutaneous Infliximab In The U.S.: Defining CT-P13 SC's Competitive Edge

By Rose Joachim, Ph.D., senior healthcare analyst, GlobalData Plc

After more than 20 years on the market, TNF inhibiting biologics still reign supreme when treating immunological  diseases. While most of these products benefit from lingering patent protection in the U.S., Johnson and Johnson’s (J&J’s) intravenous (IV) TNF inhibitor, Remicade, was the first to confront loss of exclusivity and biosimilar competition in 2016. However, despite infliximab biosimilars entering the U.S. market almost five years ago, uptake has been exceptionally slow, with biosimilars representing only about 15% of the infliximab market by mid-year 2020.1

diseases. While most of these products benefit from lingering patent protection in the U.S., Johnson and Johnson’s (J&J’s) intravenous (IV) TNF inhibitor, Remicade, was the first to confront loss of exclusivity and biosimilar competition in 2016. However, despite infliximab biosimilars entering the U.S. market almost five years ago, uptake has been exceptionally slow, with biosimilars representing only about 15% of the infliximab market by mid-year 2020.1

J&J’s Remicade has another potential challenge ahead in the U.S.: the launch of the first subcutaneous (SC) infliximab product. The drug, CT-P13 SC, is a reformulated version of Celltrion’s IV infliximab biosimilar, Inflectra/Remsima, which is marketed by Pfizer in the U.S. This “bio-better” has already been approved and launched in Europe as Remsima SC and is quickly achieving strong sales.

GlobalData believes that Celltrion’s CT-P13 SC will likely see better success than IV infliximab biosimilars in the U.S. In Part 1 of this two-part article series, we assess the factors that may give CT-P13 SC a competitive edge over Remicade and IV infliximab biosimilars. In Part 2 we evaluate the potential impact of CT-P13 SC on different autoimmune indications and explore the ways in which the TNF inhibitor class may be affected.

Background

Celltrion’s Remsima SC gained European approval in November 2019 for the treatment of rheumatoid arthritis (RA).2 A few months later, it was approved for all other indications that IV Remsima is used to treat.3 These include ankylosing spondylitis (AS), Crohn’s disease (CD), ulcerative colitis (UC), psoriatic arthritis (PsA), and psoriasis (PsO). Remsima SC is available as a 120-mg pen or prefilled syringe and is administered as a bi-weekly maintenance therapy following initial loading doses with Remsima IV. Sales growth for this agent has been strong: in 2020, the drug accrued $479 million — more than half the sales that Remsima IV/Inflectra achieved worldwide during the same time period.4–6

Celltrion is now pursuing clinical development of CT-P13 SC in the U.S. While the EMA approved Remsima SC as a line extension for Remsima IV, the FDA has required Celltrion to submit the product as a new drug. CT-P13 SC is dosed and administered differently than Remicade, so the drug could not be approved as a biosimilar. Likewise, because Inflectra was approved via the abbreviated biosimilar pathway, the agency did not have an official process to add a supplemental license for a new formulation. However, Celltrion did not have to start from square one. Based on data available from the company’s clinical trials in Europe, the FDA permitted the company to skip Phase 1 and 2 trials.7 In October 2019 and September 2020, the company started Phase 3 studies of CT-P13 SC in the treatment of CD (NCT03945019) and UC (NCT04205643), respectively. The primary completion dates for the trials are expected in June 2021 for CD and January 2022 for UC; FDA approval is anticipated in Q2 2022.

As there is no precedent for the approval of a “bio-better” in the U.S., it is unclear whether CT-P13 SC will be approved for all of the same indications as IV infliximab or only those evaluated in the pivotal trials (CD and UC). Considering the FDA’s willingness to use European data to expedite the drug’s development, it is possible the agency may also use these data to extrapolate approval to RA or potentially the entire breadth of IV infliximab indications. However, this assumes the FDA is looking to set new regulatory precedents for bio-better products. If CT-P13 SC does not receive special treatment, all additional approvals beyond UC and CD will require separate clinical trials. In this article series, we consider both possibilities, but focus on the latter one.

Say Goodbye To Infusions

GlobalData believes that although CT-P13 SC will experience some of the same roadblocks as IV infliximab biosimilars in the U.S., there is enough differentiating it to assume unique uptake dynamics. With its unique SC formulation, CT-P13 SC brings something entirely new to the table. And it is unlikely to face competition anytime soon. Patent protections for the formulation and dosage of CT-P13 SC are expected to extend until 2037 and 2038, respectively, across the U.S. and a wide range of countries in Europe and Asia.8 If the patents go unchallenged, Celltrion could have a monopoly on subcutaneous infliximab for the next 17 years.

A SC formulation may help CT-P13 SC gain some traction with payers, a feat that has beleaguered companies looking to market IV infliximab biosimilars in the U.S. For the first time, patients receiving maintenance infliximab will have the option to self-administer their treatment at home. Considering the amount of time patients must invest when receiving IV drugs, both for travel and infusion, an SC option has the potential to greatly improve the quality of life for hundreds of thousands of patients. Particularly in indications like UC and CD, for which infliximab is gold standard first line biologic treatment, this could be quite impactful.

Not only would CT-P13 SC offer patients more freedom but removing the need for outpatient infusion visits could provide significant new cost savings. Based on economic evaluations of IV and SC therapy in autoimmune diseases in the U.S., administration costs for IV treatment typically account for 6 to 15% of the total therapeutic cost.9–11 Although this may seem like a small percentage, these savings make a difference when the total cost of care is high.

In a budget impact analysis presented at the 2020 EULAR Congress, researchers Perry and Jang compared the theoretical five-year cost of treatment for RA patients in the U.K. with or without the availability of CT-P13 SC.12 The calculations assumed CT-P13 SC drug costs to be similar to “comparator treatments” (not specified, but likely adalimumab biosimilars) and administration costs to be ₤382 ($521) per infusion and ₤3.32 ($4.53) per SC administration. At the initial IV infliximab dose for RA (3 mg/kg once every eight weeks) researchers estimated that CT-P13 SC would lead to cost savings of ₤39.6 million ($54.1 million) in the U.K. over a five-year period. With dose-escalation to 5 mg/kg of IV infliximab, a common occurrence in RA, savings increased to ₤279.6 million ($381.7 million). Although not explored in Perry and Jang’s study, the potential for savings grows even further when one considers the uptake of CT-P13 SC in indications outside of RA, all of which require treatment with 5 mg/kg IV infliximab or higher. Based on GlobalData’s analysis, U.S. infliximab sales totaled approximately $3.6 billion in 2019, 60% of which came from indications other than RA.

Biosimilar Price Point

Removing the inconveniences and costs of infusion therapy are important strengths of CT-P13 SC. However, to secure the best possible coverage in the U.S., Celltrion will also need to price its drug competitively. Payers interviewed by GlobalData stressed that deep discounts would be the only way biosimilars would gain preferred status in a market so strongly defined by contracting agreements. It is possible that the bar to clear might be slightly lower given the additional savings in medical benefits, but drug cost is going to be a key factor defining access.

A major reason for the slow uptake of IV infliximab biosimilars in the U.S. was a lack of cost savings compared with Remicade. When launched, the first IV infliximab biosimilar products, Inflectra and Renflexis, offered discounts that were easy for J&J to match; payers simply renegotiated their contracts with the company and moved on. Although this was good for payers and patients in that it brought down the cost of infliximab overall, it stymied the growth of biosimilar business, potentially limiting cost-cutting competition in the future. Currently, there are three IV infliximab biosimilars on the U.S. market with wholesale acquisition cost (WAC) prices ranging from 81% to 43% that of Remicade. In the last few years, increasingly deeper discounts have begun to allow the uptake of IV infliximab biosimilars to pick up steam.

Based on publicly available pricing data from the U.K. and Italy, Celltrion does appear eager to make the cost of Remsima SC as competitive as possible, right from the start. Assuming an IV infliximab regimen of 5 mg/kg every eight weeks (average cumulative dose of 2,779 mg per year), the annual cost of Remsima SC (average cumulative dose of 3,240 mg per year), is 16 to 17% lower than Remicade and 1 to 8% lower than Remsima IV. If we assume CT-P13 SC will be discounted similarly in the U.S. (17% off the Remicade WAC price), the drug will cost only 1% more than Pfizer/Celltrion’s Inflectra but 32% and 99% more than Merck’s Renflexis and Amgen’s Avsola, respectively. However, it should be noted that these comparisons are based on WAC pricing and may not reflect true costs after confidential payer discounts and rebates. Additionally, based on Celltrion’s Q4 2020 earnings presentation, Inflectra has a stronger hold on the market than its biosimilar competitors, claiming 64% of infliximab biosimilar share.6 This hold will likely be strengthened by the launch of a new SC formulation.

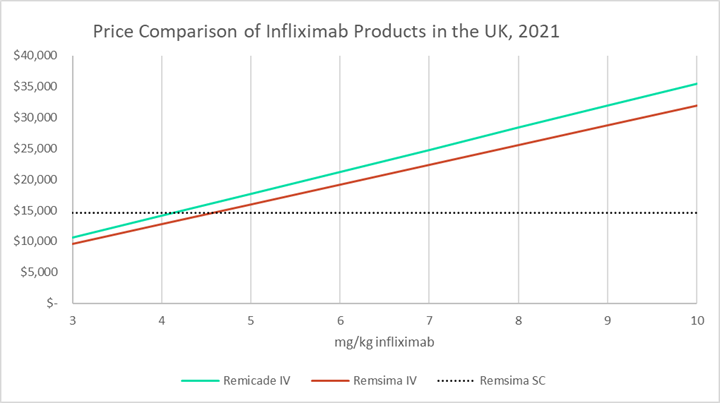

The graph below uses U.K. pricing data, converted to USD, to compare the annual cost of therapy for a range of doses of IV Remicade and IV Remsima to a theoretical constant annual cost of therapy for Remsima SC. Annual costs for IV infliximab assume dosing every eight weeks in patients with an average weight of 78.44 kg.13 Annual costs for Remsima SC assume dosing every two weeks at 120 mg per dose.

Theoretically, at higher doses of IV infliximab, the SC formulation is increasingly cost competitive. Dose escalation is a common strategy used by physicians when patients lose their response to IV infliximab over time. In particular, there are specific provisions in the FDA guidelines for RA and CD that suggest increasing the dose up to 10 mg/kg and the dosing frequency up to once every four weeks. In fact, for RA, although regulatory labels suggest dosing patients at 3 mg/kg, real-world data suggest that on average, RA patients receive maintenance doses of 5 mg/kg or higher.9,14 Off-label dose escalation is also seen in the treatment of UC and other indications.

However, it is important to note that CT-P13 SC has only been deemed non-inferior to IV infliximab when dosed at 5 mg/kg every eight weeks — no study has yet explored this comparison using higher or more frequent dosing.15 This type of research study would be very useful for Celltrion to perform, as it could bolster arguments for cost savings. It may be that patients who require higher doses of IV infliximab are simply not good candidates for CT-P13 SC, but this is unlikely to cut too deeply into the drug’s potential market share.

Based on the factors described above, GlobalData expects that compared to IV infliximab products, CT-P13 SC will demonstrate unique uptake dynamics and competitive power against Remicade. In Part 2 of this series, we estimate the future uptake of CT-P13 SC across indications in the U.S. and assess the potential impacts on the TNF inhibitor class.

References

1. Celltrion Inc. 2Q 2020 Earnings Release. https://celltrion.com/en-us/irs/resultdata

2. Celltrion Healthcare receives EU marketing authorisation for world’s first subcutaneous formulation of infliximab, Remsima SCTM, for the treatment of people with rheumatoid arthritis. https://www.businesswire.com/news/home/20191125005867/en/Celltrion-Healthcare-receives-EU-marketing-authorisation-for-world’s-first-subcutaneous-formulation-of-infliximab-Remsima-SCTM-for-the-treatment-of-people-with-rheumatoid-arthritis

3. European Commission grants marketing authorisation for world’s first subcutaneous formulation of infliximab, Remsima® SC, for an additional five indications including for use in inflammatory bowel disease and ankylosing spondylitis. https://www.businesswire.com/news/home/20200727005371/en/European-Commission-grants-marketing-authorisation-for-world’s-first-subcutaneous-formulation-of-infliximab-Remsima®-SC-for-an-additional-five-indications-including-for-use-in-inflammatory-bowel-dis

4. Celltrion Healthcare. Celltrion Healthcare 2Q20 IR Material. https://www.celltrionhealthcare.com/en-us/ir/earning

5. Celltrion Healthcare. Celltrion Healthcare 4Q20 IR Material. https://www.celltrionhealthcare.com/en-us/ir/earning

6. Celltrion Inc. FY 2020, 4Q20 Earnings Release. https://celltrion.com/en-us/irs/resultdata

7. Celltrion completes FDA filing for phase 3 study of Remsima SC in U.S. https://pulsenews.co.kr/view.php?year=2019&no=196451

8. Celltrion Healthcare receives positive CHMP opinion for an additional five indications for Remsima® SC including for use in inflammatory bowel disease. https://www.celltrionhealthcare.com/en-us/board/newsdetail?modify_key=317&pagenumber=2&keyword=&keyword_type=

9. Ellis LA, Malangone-Monaco E, Varker H, et al. Comparative analysis of US real-world dosing patterns and direct infusion-related costs for matched cohorts of rheumatoid arthritis patients treated with infliximab or intravenous golimumab. Clinicoecon Outcomes Res. 2019;11:99-110. doi:10.2147/CEOR.S185547

10. Schmier J, Ogden K, Nickman N, et al. Costs of Providing Infusion Therapy for Rheumatoid Arthritis in a Hospital-based Infusion Center Setting. Clin Ther. 2017;39(8):1600-1617. doi:https://doi.org/10.1016/j.clinthera.2017.06.007

11. Wong BJ, Cifaldi MA, Roy S, Skonieczny DC, Stavrakas S. Analysis of drug and administrative costs allowed by U.S. Private and public third-party payers for 3 intravenous biologic agents for rheumatoid arthritis. J Manag Care Pharm. 2011;17(4):313-320. doi:10.18553/jmcp.2011.17.4.313

12. Perry M, Jang M. AB1185 BUDGET IMPACT ANALYSIS OF INTRODUCING SUBCUTANEOUS INFLIXIMAB CT-P13 SC FROM THE UK PAYER PERSPECTIVE. Ann Rheum Dis. 2020;79(Suppl 1):1883 LP - 1883. doi:10.1136/annrheumdis-2020-eular.3422

13. NHS Digital. Health Survey for England 2018.; 2019. https://digital.nhs.uk/data-and-information/publications/statistical/health-survey-for-england/2018

14. Greenberg JD, Reed G, Decktor D, et al. A comparative effectiveness study of adalimumab, etanercept and infliximab in biologically naive and switched rheumatoid arthritis patients: results from the US CORRONA registry. Ann Rheum Dis. 2012;71(7):1134 LP - 1142. doi:10.1136/annrheumdis-2011-150573

15. Schreiber S, Leszczyszyn J, Dudkowiak R, et al. Noninferiority of Novel Subcutaneous Infliximab (CT-P13) to Intravenous Infliximab (CT-P13) in Patients with Active Crohn’s Disease and Ulcerative Colitis: Week 30 Results from a Multicentre, Randomised Controlled Pivotal Trial. United Eur Gastroenterol J. 2019;7(10):1411-1425. doi:10.1177/2050640619888859

About The Author:

Rose Joachim, Ph.D., is a senior healthcare and pharmaceutical analyst at GlobalData. As an analyst, she has authored numerous reports and articles analyzing market dynamics within the autoimmune, allergic, and hematological disease spaces. In 2017, Joachim earned her Ph.D. in biological sciences in public health at Harvard University. Her dissertation research explored the effects of age on immune system function during sepsis. When she wasn’t at the bench, she spent her time teaching and developing new science curricula as part of the Science Education and Academic Leadership certificate program at Harvard. Prior to her graduate studies, Joachim earned her B.S. in biology with a minor in chemistry from The College of New Jersey.

Rose Joachim, Ph.D., is a senior healthcare and pharmaceutical analyst at GlobalData. As an analyst, she has authored numerous reports and articles analyzing market dynamics within the autoimmune, allergic, and hematological disease spaces. In 2017, Joachim earned her Ph.D. in biological sciences in public health at Harvard University. Her dissertation research explored the effects of age on immune system function during sepsis. When she wasn’t at the bench, she spent her time teaching and developing new science curricula as part of the Science Education and Academic Leadership certificate program at Harvard. Prior to her graduate studies, Joachim earned her B.S. in biology with a minor in chemistry from The College of New Jersey.