CMS' Coverage Gap Is A Significant Challenge For Biosimilars

By Molly Burich, Associate Director, Public Policy – Biosimilars, Pipeline and Reimbursement, Boehringer Ingelheim Pharmaceuticals, Inc.

Today it is hard to read anything about specialty drugs without a mention of the potential cost savings offered by biosimilars. Estimates of their potential savings vary – on the high end, some estimates suggest a savings of $66 billion by 2024.1 While stakeholders from patients to physicians, payers, and policymakers would like to realize the full potential of biosimilars in the United States, the challenge that remains is ensuring that reimbursement incentives are adequate to ensure their uptake and long-term utilization.

Before diving into the reimbursement issues, let’s revisit biosimilars. Biosimilars are biologic medicines that are deemed by the FDA to be highly similar to already-approved reference products notwithstanding minor differences with no clinically meaningful differences in terms of safety, purity, and potency.2 While abbreviated, the pathway for biosimilar approval includes rigorous testing and review by the FDA to ensure that the biosimilar is highly similar to the reference product. Because biologics are grown from living organisms, it is impossible to develop an exact copy of the original drug.

To date, the FDA has approved four biosimilars; two are currently on the market (Sandoz' ZARXIO®* [filgrastim-sndz] and Pfizer/Celltrion's INFLECTRA®* [infliximab-dyyb]). With biosimilars starting to become established in the United States, now is the time to ensure the existing reimbursement systems are appropriately structured to drive biosimilar uptake.

Unfortunately, at the federal level, the Centers for Medicare and Medicaid Services (CMS) has implemented a series of inconsistent policies on biosimilars that may impact their uptake and savings potential. As discussed in an earlier guest column, all biosimilars for a particular reference product are assigned one J-code by CMS and reimbursed at a blended rate. This effectively treats biosimilars as generic products and assumes they are all equal to one another. However, CMS’ policy for Medicaid pricing takes the opposite approach -- in recent guidance, CMS reaffirmed biosimilars will be considered branded and manufacturers will be required to pay the 23.1 percent rebate for branded products3, mandated by the Affordable Care Act (ACA).

While these opposing views from the same government agency are concerning, perhaps the most immediate challenge for biosimilars is posed by Medicare Part D’s “donut hole” or coverage gap. This term refers to a specific phase of coverage where the patient pays for a higher proportion of their drug costs until they hit a CMS-mandated dollar amount. In 2017, the coverage gap begins after the patient reaches $3,700 in drug spend. Once the patient spends $4,950, the patient leaves the donut hole and the patient's out-of-pocket drug cost is significantly reduced for the remainder of the year.4

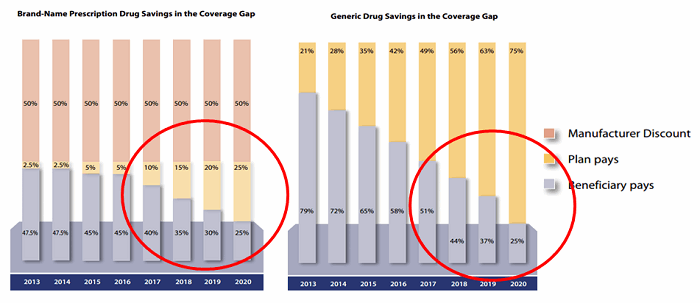

Navigating the coverage gap can be challenging, as the ACA mandated that a 50 percent rebate be paid by manufacturers for all branded drugs during the coverage gap. The ACA statute that mandates this discount policy -- the Coverage Gap Discount Program (CGDP) -- excludes both generic and biosimilar products from being discounted. The impact of the differentiation between brand and generic/biosimilars affects both patients and Part D plans.

What Does This Mean for Patients?

- The impact of biosimilars being excluded from the CGDP is twofold for patients:

- They face a higher cost share for a biosimilar

- They remain in the donut hole longer

- While the patient is in the donut hole, the 50 percent manufacturer rebate on branded drugs counts toward the patient’s true out-of-pocket (TrOOP) costs, thus moving the patient through the donut hole faster and helping to reduce the cost to patients.

- Since biosimilars are excluded from the CGDP, any discount offered to the plan on the biosimilar would not count toward TrOOP and therefore, the patient has both higher cost share and is in the donut hole longer than if they were on a branded drug.

- Notably, the coverage gap closes for patients in 2020; patients will pay 25 percent of the cost of a branded or generic/biosimilar drug once they reach the coverage gap. However, the impact to TrOOP will still result in the patient being in the coverage gap longer if they take a biosimilar.

What Does This Mean for Part D Plans?

- The impact of biosimilars being excluded from the CGDP is:

- As evidenced in Figure 1 below, the cost of the biosimilar will be higher to the plan through 2020 and beyond:

- Plan responsibility for a brand product in the donut hole in 2020: 25 percent

- Plan responsibility for a generic product in the donut hole in 2020: 75 percent

- As evidenced in Figure 1 below, the cost of the biosimilar will be higher to the plan through 2020 and beyond:

- The result of this policy makes it potentially very unlikely for a Part D sponsor to push the use of biosimilars under Medicare Part D

Figure 1

While CMS guidance has clarified that biosimilars can be added to the formulary at any time during the year5, as a result of the CGDP we are unlikely to see much effort from Part D sponsors as long as the patient and Part D plan financial disincentives exist. Perhaps in an effort to address this circumstance, CMS has clarified that the inclusion of a biosimilar and the removal of a reference product midyear can be evaluated on a case-by-case basis. This guidance opens the door for a Part D sponsor to encourage biosimilar uptake, if the financial disincentives are removed.

Solutions have been suggested. Last year, Avalere Health conducted an independent analysis on this topic and outlined two potential solutions6:

- Allow biosimilars to participate in the CGDP and pay the 50 percent rebate

- Allow CMS to create a new biosimilar tier (and necessary program rules) to give Part D plans flexibility on how they manage (e.g., coverage, specify cost share, etc.) biosimilars

Note that either change requires legislative action. While both represent potential solutions, the first is the more likely and timely solution as it can be utilized for approved, but not-yet-marketed, biosimilars under Medicare Part D.

As the U.S. biosimilars market is in its infancy, reimbursement policies to appropriately support their use are essential, and CMS is positioned to play a pivotal role in the development of these policies. Addressing the coverage gap in Part D is a critical place to start.

*Zarxio® is a registered trademark of Novartis AG and Inflectra® is a registered trademark of Hospira, a Pfizer company.

References:

- Andrew W. Mulcahy, Zachary Predmore, and Soeren Mattke. RAND Corporation. The savings potential of biosimilar drugs in the United States. 2014. https://www.cbo.gov/sites/default/files/110th-congress-2007-2008/costestimate/s16950.pdf. Accessed March 24, 2016.

- FDA Website. http://www.fda.gov/downloads/drugs/developmentapprovalprocess/howdrugsaredevelopedandapproved/approvalapplications/therapeuticbiologicapplications/biosimilars/ucm428732.pdf

- CMS Website: https://www.medicaid.gov/Medicaid-CHIP-Program-Information/By-Topics/Prescription-Drugs/Downloads/Rx-Releases/MFR-Releases/mfr-rel-103.pdf

- CMS Website: https://q1medicare.com/PartD-The-2017-Medicare-Part-D-Outlook.php

- CMS Website: www.amcp.org/WorkArea/DownloadAsset.aspx?id=19358

- Avalere Health Website: http://go.avalere.com/acton/attachment/12909/f-02c0/1/-/-/-/-/20160412_Patient%20OOP%20for%20Biosimilars%20in%20Part%20D.pdf

About The Author:

In addition to holding the position of Reimbursement Policy Chair for the Biosimilars Forum, Molly Burich is the associate director, public policy — biosimilars, pipeline, and reimbursement for Boehringer Ingelheim Pharmaceuticals.

In addition to holding the position of Reimbursement Policy Chair for the Biosimilars Forum, Molly Burich is the associate director, public policy — biosimilars, pipeline, and reimbursement for Boehringer Ingelheim Pharmaceuticals.