How To Win Over U.S. Payers On Biosimilars

A conversation with John Greenaway of Trinity Partners

Payers are widely considered the gatekeepers to the U.S. market for biosimilars. If you can address their specific concerns related to price, contract terms, evidence, FDA designation, and other factors, they will eagerly grant you access to patient populations who are yet to reap the benefits of biosimilars. Easy, right?

For insights and strategies on how to solve this complicated payer puzzle, Biosimilar Development reached out to John Greenaway, principal at Trinity Partners. Greenaway co-authored the article “Why So Slow? Demystifying The Barriers To U.S. Biosimilar Adoption”, which was published on Biosimilar Development in December, and was a major contributor to a new white paper called “The State of US Biosimilars Market Access: Payer Perceptions of Past, Present, and Future Hurdles to Adoption.” His work on the white paper involved surveying U.S. payers about their views on topics like pricing, contracting, interchangeability, and more, and he shares some of his learnings in this Q&A.

In surveying payers for the white paper, did you find yourself surprised by any particular responses to biosimilars from the different payers? What was surprising and why?

Before speaking to payers as part of our research, our hypothesis was that payers would be lukewarm toward biosimilars, given the slow uptake of launched biosimilars to date, for which restrictive payer policies may be at least partially to blame. Accordingly, we were surprised by payers’ generally high hopes for biosimilars in the future, with some stating they expect north of 75 percent class share going to biosimilars eventually. Of course, their anticipation of either a future increase in interchangeability studies or changes in interchangeability rules is baked into this expectation, as they understand the significance this factor will have on biosimilar adoption and their ability to influence market behavior with formulary and controls.

Before speaking to payers as part of our research, our hypothesis was that payers would be lukewarm toward biosimilars, given the slow uptake of launched biosimilars to date, for which restrictive payer policies may be at least partially to blame. Accordingly, we were surprised by payers’ generally high hopes for biosimilars in the future, with some stating they expect north of 75 percent class share going to biosimilars eventually. Of course, their anticipation of either a future increase in interchangeability studies or changes in interchangeability rules is baked into this expectation, as they understand the significance this factor will have on biosimilar adoption and their ability to influence market behavior with formulary and controls.

Did you find that the business model — large national/mid-size or small regional — had any impact on payers’ approaches to biosimilars?

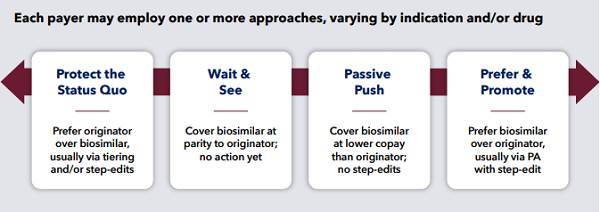

We identified four general buckets of payer approaches to biosimilar coverage: status quo, wait and see, passive push, and prefer and promote. In our payer interviews, we did not identify a correlation between plan size and a payer’s self-described approach to biosimilar coverage. However, most indicated that they would consider biosimilar products on a case-by-case basis rather than having a single coverage policy and guidelines for biosimilar use as a class.

Figure 1: Biosimilar management philosophies (Image source: Trinity Partners white paper “The State of US Biosimilars Market Access: Payer Perceptions of Past, Present, and Future Hurdles to Adoption”)

A lot of the payers you worked with were in the wait-and-see and passive-push categories. Apart from more time and comfort with biosimilars, in what ways can biosimilar companies actively impact a payer’s approach in the next few years?

Interchangeability status will be highly impactful in the near-term for payers. This status will likely be the predominant factor until such time as there is widespread acceptance of and clinical comfort with biosimilars and the biosimilarity status at large. Based on our research, it appears that payers will be reluctant to actively restrict originators in favor of biosimilars, unless the biosimilar has demonstrated interchangeability. However, once interchangeability data is available, payers expressed greater willingness to more actively “emphasize” biosimilars (for example, via formulary restrictions such as step-edits). Short of full interchangeability studies, any data that the biosimilar company can provide on real-world evidence of safe and efficacious switching from the originator to the biosimilar would support payers as they migrate towards taking a more active stance on biosimilars.

In today’s increasingly scrutinized but nevertheless relevant contracting environment, the other obvious way to impact a payer’s approach to biosimilars is to compete on net price (price after discounts/rebating). One payer mentioned his organization had yet to receive any biosimilars contract offers for consideration.

You mentioned the importance of building strong contracting strategies in a recent article. What might these strategies look like?

The value of any contract strategy must take into account the so-called “rebate trap,” in which originator manufacturers establish rebate contracts based on the share of class or total patient volumes. In these contracts, as innovator share drops or as patients on innovator products flatten and start to decline, the contract value on a per unit basis to the payer also declines. Given that the innovator unit volumes are very high to start and uptake of biosimilars would like be slow if limited to new patient starts, the impact of a small per-unit contracting loss can be very high in total dollars. This lost payer value would need to be made up by a difference in price or contract value by the biosimilar manufacturers before payers would push for such a switch. One strategy would be to push for fast conversion (likely needing to include a significant portion of continuing patients, not just new starts). In that case, there are scenarios and strategies where short-term losses might still remain, but they can be offset by long-term gains in reduced total expenditures after conversion of 70 percent+ of the baseline business.

Are there conversations you feel need to be had between payers and biosimilar companies that aren’t currently occurring, or ones that need to be re-approached?

There needs to be more big-picture conversations around contracting and value offerings needed to begin switching payers’ covered lives from originator biologics to biosimilars. There needs to be transparency and problem solving with regards to the rebate trap in place at a particular payer, so that biosimilar companies know what benchmarks they need to hit before they can potentially drive use within a certain plan. Payers are interested in biosimilars success, but they need to be able to offset and minimize short-to-mid-term losses with long-term gains while going through the process of switching a subset of their covered patients from originator to biologics. Payers need to have an open conversation with biosimilar manufactureres to effectively communicate their expectations surrounding interchangeability and contracting.

Outside of the Medicare Part B and D changes, do you foresee any other changes to how contracting is carried out with payers in the near future?

In the current regulatory environment, we don’t anticipate that contracting will change across the board in the near future — discounts and rebates are important sources of value for payers. However, as the scrutiny of pharmaceutical pricing and contracting practices intensifies, we expect that targeted changes may be in store. As an example, see FDA Commissioner Gottlieb’s March testimony on access to care. If any targeted changes were to occur, biosimilar pricing and contracting would certainly be public enemy #1. The key uncertainty at this point would be that that the Federal Trade Commission (FTC) is more likely the proper U.S. government regulatory authority (relative to the FDA), and it’s unclear if FTC shares any of the perspectives and objectives Commissioner Gottlieb has expressed. Further, any attempted change by either FDA or FTC to limit biosimilar pricing and contracting behavior would be dramatically modifying rules that have existed broadly across pharmaceuticals for the better part of the past two decades — and which have been validated several times across a variety of legal challenges and case law.

Some payers were particularly interested in seeing interchangeability gain ground before moving on the biosimilar. Do you anticipate interchangeability for certain products will end up being driven by payers? And if so, to what extent?

From our research, it is certainly evident that payers are eager to see interchangeability studies before they start actively pushing biosimilar switches on providers and patients. Meanwhile, manufacturers are often reluctant to invest the significant time and cost required to demonstrate interchangeability. To the extent that payers hold many of the keys to biosimilar markets today, this may mean that the influence of payers does indeed drive manufacturers to invest in interchangeability; if they don’t, they may find themselves shut out of increasingly restrictive formularies.